Issue #39 - Hong Kong-Singapore 2.0: Is Tourism in Asia Running Out of Options?

"If this fails for a second time, what happens next?"

Hello. Welcome to Asia Travel Re:Set…

“New flights launched between Singapore and Hong Kong.”

Two years ago, that statement would have garnered little media attention. Entire news shows would not have been dedicated to it. Maybe not even a press release.

But version 2.0 of the Hong Kong-Singapore air travel bubble is prime time in Asia.

The world beyond is often mystified by the region’s preoccupation with travel bubbles. But with deep governmental caution prevailing, few other cards are on the table.

Asia Pacific is in the fearful grip of new COVID-19 waves, and the options for restoring travel routes and frequencies are retreating.

As we noted on this week’s The South East Asia Travel Show:

“The one thing we’ve learned over the first 4 months of 2021 is just how difficult it is going to be to get out of this situation.”

It was another worrying week...

India’s heartbreaking COVID-19 catastrophe saw numerous countries close their few connecting flight paths. Humanitarian aid is being air-lifted. Panic is spreading.

India’s tragic shadow hangs over the entire region.

Vietnam recorded its first locally transmitted cases in over a month, and identified the ‘Indian variant.’ Its health authorities warn of “a new outbreak in the country”. Extra measures are in force in major cities. Cambodia and Laos are tightening lockdowns. Overall, one quarter of a million active cases are registered across South East Asia.

Meanwhile, Thailand reversed its decision to halve (and later eliminate) quarantine for vaccinated travellers. It’s back to 14 days. Malaysia extended its domestic travel ban, and a new lockdown is being discussed for Kuala Lumpur and other ‘red zone’ states.

“If” the rebooted bubble takes off on 26 May, those new flights between Hong Kong and Singapore will make bigger news than previously anticipated.

Asia’s tourism industry is running out of unvaccinated options.

Thanks for being on board,

Gary

The Sunday Itinerary

- DashBoard

From 120 trillion down to 4 in Asia Pacific this week.

- QuoteBoard

Thailand, Malaysia, Bali.

- Asia Pacific Retreats From Travel

- Hong Kong-Singapore Travel Bubble: That Was Then, And Then. This is Now.

DashBoard

From 120 trillion down to 4 in Asia Pacific this week…

VND120 trillion: The Airports Corporation of Vietnam says it needs this much funding to complete scheduled infrastructure projects by 2025. [Vietnam Plus]

265 million: Predicted number of domestic air, train and road trips in China during the 1 May public holiday. [Chinese Ministry of Transport]

42,000: Air New Zealand enjoyed its busiest pandemic-era day on 23 April with 520 domestic and Trans-Tasman flights. [Company Statement]

14: Thailand restores its mandatory 14-day quarantine for inbound arrivals regardless of vaccination status. [The Straits Times]

4%: Of survey respondents in Malaysia cited “travel to other places” as the primary reason to register for a COVID-19 vaccine. [Vase.ai]

QuoteBoard

You heard it here…

“The COVID-19 outbreak situation does not seem to be improving… but rather the opposite, as presently there has been another COVID-19 outbreak which is more severe and serious than the previous outbreak. In addition, the Company has not yet received any support from soft loan measures from the government.”

Thai AirAsia sets out its reasoning for securing an investor loan and restructuring the company ahead of a public listing. [Company Statement]

“This [current no interstate travel policy] should be retained until we achieve 80% herd immunity.”

Malaysia’s Health Minister, Dr Adham Baba, appears to rule out domestic travel for much of 2021. [New Straits Times]

“Kuta must be embarrassed by this condition. Let us jointly carry out tourism recovery with discipline so that Kuta is clean from COVID-19. Hopefully when tourism opens, Kuta is ready.”

Nyoman Gatra, Kuta Police Commissioner, laments the coastal town of Kuta not being included with Nusa Dua, Sanur and Ubud as Bali tourism ‘green zones’. [The Bali Beat]

Asia Pacific Retreats From Travel

The outlook for travel in Asia Pacific is at the lowest point so far in 2021.

Other than the Australia-New Zealand travel bubble, a mini bubble between Taiwan and Palau (which was temporarily paused due to '“lack of interest”) and the upcoming Hong Kong-Singapore version 2.0, little else is active.

This week, Vietnam’s Quang Nam province proposed a travel bubble with South Korea. That now looks unlikely since local infections began rising again.

“Thailand’s Phuket Sandbox looks precarious. That does not mean it won’t happen, though.”

Bali remains steadfast about reopening the islands of Batam, Bintan and Bali, although a domestic travel ban is in place for the upcoming Eid al-Fitr holidays. Thailand’s Phuket Sandbox appears precarious. That does not mean it won’t happen, though.

There is still some talk on the table. Singapore and Taiwan are weighing up a bilateral bubble, and it was widely reported this week that Singapore’s standing bubble invitation to Australia still, well, stands.

These temporary, low-scale point-to-point solutions are as good as it gets. A month ago, the Asia Pacific region was actively seeking a 'turning point’ for travel. Now many countries are bracing for worsening waves of COVID-19.

“Confidence in travel safety at governmental levels is very low in Asia Pacific.”

With parts of Europe preparing to reopen (more judiciously than in 2020) for the summer, confidence in travel safety at governmental levels is very low in Asia Pacific.

For example, the 10-member ASEAN (the Association of South East Asian Nations) is no longer even whispering about a regional reopening strategy. Active case levels, containment and vaccine strategies and societal standpoints are just too diverse.

“The 10-member ASEAN is no longer even whispering about a regional strategy.”

With the region’s mega market, China, focusing squarely on domestic tourism, Japan preoccupied by its own pre-Olympic containment struggles and South Korea making slow progress with vaccinations, the key intra-Asian markets are off radar.

In recent months, 3 key factors combined to erode governmental confidence in travel:

1) The continued prevalence of ‘imported’ cases via international flights.

2) Japan’s refusal to approve even short-term inbound travel to attend its highly proclaimed, era-defining showpiece event, the delayed 2020 Tokyo Olympics.

3) Slow supplies of vaccines aligned with high levels of vaccine scepticism.

Two additional factors are now deepening the levels of concern:

4) New, more transmissible COVID-19 variants.

5) India.

It is impossible to overstate the fear that India’s critical situation is causing. This ranges from Australia threatening its citizens with jail sentences if they attempt to fly home from India to Maldives introducing new measures for visitors from its top source market. Deep concerns for family and friends back home exist in countries with large Indian communities, such as Singapore, Malaysia, Australia and New Zealand.

Chinese President Xi Jinping even reached out to India’s Prime Minister Narendra Modi this week, which would not otherwise have been on any agenda.

Hong Kong-Singapore Travel Bubble: That Was Then…

Asia Travel Re:Set - Issue #16

On 15 November 2020, a few days before version 1.0 of the Hong Kong-Singapore bubble burst, I analysed 15 implications for travel in a pandemic. These included:

2 Destinations, 2 Airports & 2 Airlines

Air Travel by Protocol

Controlled & Scaleable Quotas

The Coronavirus is Still in Control

“This carefully scripted agreement won’t scratch the surface of the systemic drag-downs on both travel economies. But as we near the final month of 2020, it engenders hope. A subtle hint of renaissance before vaccine travel takes hold.”

… And Then…

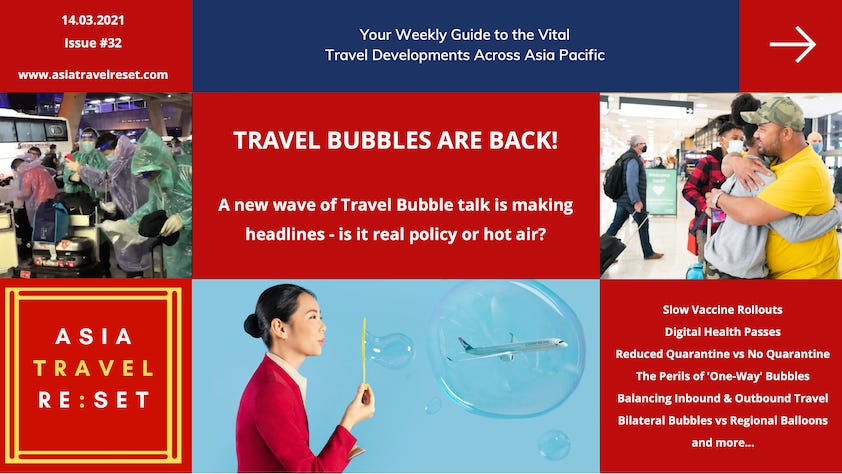

Asia Travel Re:Set - Issue #32

On 14 March 2021, I discussed why Travel Bubbles were back in vogue. This included:

Vaccine Rollouts are Slower Than Hoped

Reduced Quarantine vs No Quarantine

The Perils of ‘One-Way’ Bubble Thinking

Micro Bubbles vs Regional Balloons

“Travel Bubble fever broke out this week in Asia Pacific. Again. It feels like a flashback to 6 months ago. Most of these discussions gained form in October 2020, when the original Singapore-Hong Kong Air Travel Bubble was unveiled. The problem today, just as then, is disentangling the substance from the spin.”

This is Now…

The re-floated Hong Kong-Singapore Air Travel Bubble is set for take-off on 26 May, some 6 months and 4 days after its planned launch on 22 November 2020.

The rhetoric has been toned down a few shades this time, but the sense of nervousness is higher. If this fails for a second time, what happens next? A wait for the vaccine wheel to turn its cycle?

“If” is the official starting point.

“If it starts, but along the way the threshold is breached, then it may well be suspended,”

said Lawrence Wong, Co-chair of Singapore's COVID-19 Task Force, adding:

“This is not a situation where new initiatives are rolled out and then they will continue permanently without any potential for disruption.”

There are still 3 weeks until take-off.

A great deal can happen during 21 days in a pandemic.

Singapore Changi International Airport

Handled 429,000 passengers from January-March 2021, compared to 11.05 million in the same 2020 period.

Hong Kong International Airport

Handled 176,000 passengers from January-March 2021, compared to 8.18 million in

the same 2020 period.

Version 2.0 of the 2-way bubble is similar to edition 1.0. Plentiful paperwork, COVID-19 tests and tracing apps. Two airlines and two airports.

Hong Kong passport holders travelling to Singapore, though, will “have to wait 14 days after they get their second dose of the Covid-19 vaccine to be eligible to travel.” Non-Hong Kong passport holders will not need an inoculation at present.

After an initial trial, two daily flights will operate in both directions from 10 June.

Echoing New Zealand Prime Minister Jacinda Ardern’s recent Trans-Tasman Bubble “flyer beware” warning, travellers who get infected with Covid-19 in Hong Kong will have to bear the full cost of medical treatment.

And the threshold for pausing the bubble…?

It will be suspended for “at least 14 days” if the 7-day moving average of unlinked local COVID-19 cases (excluding dormitory cases in Singapore) exceeds 5 in either city.

…It is pretty low.

With the pandemic now in its 14 month, what have been the biggest changes for the travel industry? Which will be temporary, and which may be permanent? On this week's The South East Asia Travel Show, we ask - and try to answer - 7 critical questions about the next steps for travel and tourism in ASEAN and Asia Pacific.

And, that’s a wrap for Issue 39.

The newsletter will take a break next weekend as I am speaking at the Domestic Tourism in Asia: Restart & Long Term Strategies online forum on 8 May, alongside senior tourism officials from China, India, Japan and Malaysia. The event is curated and moderated by Xu Jing, former Regional Director of the UNWTO.

Please click the link to join us!

Have a great week,

Gary