Issue 215: Trip.com Dominates a Dramatic Travel Week in Asia

Rounding up the hottest travel topics from China to Japan and Thailand to the Philippines.

Welcome to Issue 215 of Asia Travel Re:Set.

This week, I was going to discuss how Asia’s travel machinery is filling an extended period from New Year to the Lunar New Year holidays (centred around 17 February).

I was also going to discuss 2 new books I’m writing this year, my first since 2014.

And, then - late on Wednesday afternoon - I received an alert from Trip.com.

That message changed the shape of the week - so, let’s follow that train of thought…

Thanks for checking in.

Did you start your week with The South East Asia Travel Show?

Listeners worldwide tuned into our debut Start The Week show. This Monday morning mini-pod collates the hottest 5 travel topics in South East Asia and beyond - in just 15 minutes!

The launch show discussed a touted theme park in Thailand, Vietnam's high-octane inbound growth, Chinese cruise tourism, cross-border EV charging - and a Hajj village being built for almost a quarter of a million Indonesian pilgrims.

Back on Monday morning!

⏩ Click the live link below - or here: Disneyland Thailand, Chinese Cruising in ASEAN & Vietnam Doubles Arrivals in 9 Years: Start the Week With The South East Asia Travel Show.

Or search for The South East Asia Travel Show on any podcast app.

Trip.com Dominates a Dramatic Travel Week in Asia

It was a chastening week for China’s largest and most internationalised OTA. On Wednesday, Trip.com - which is dual-listed in Hong Kong and New York - issued a public notice that it is subject to a regulatory investigation.

China’s State Administration for Market Regulations (SAMR) stated that “based on preliminary investigations” Trip.com is under scrutiny for “suspected abuse of its dominant market position and monopolistic practices in accordance with the Anti-Monopoly Law of the People's Republic of China.”

This is a serious matter - and investors responded.

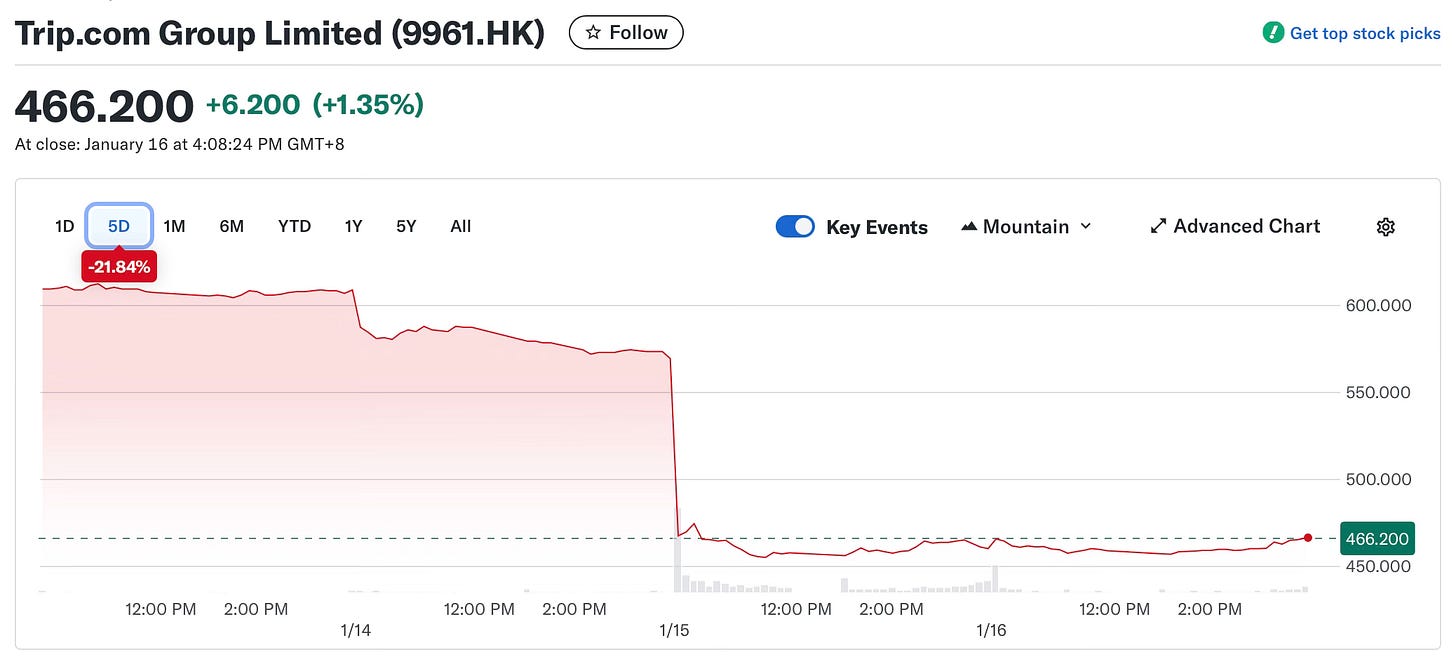

This week in Hong Kong, Trip.com’s stock price plunged from HKD612.50 to HKD466.20 at Friday’s close.

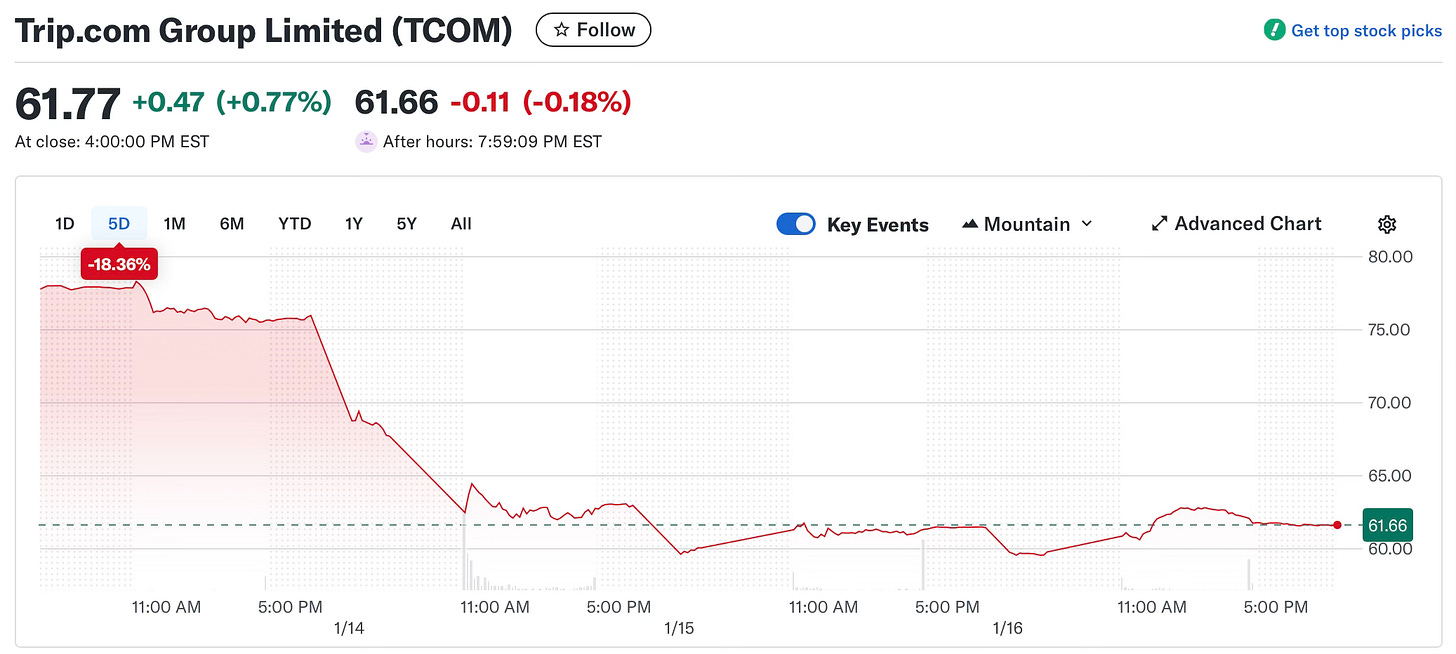

In New York, it fell from USD78.33 to USD61.77.

The market cap bleeding was stemmed on both bourses - for now - on Friday.

What happens next?

At this point, there is little merit in speculating, but Trip.com is in a tricky position.

It cannot speak publicly or protect its share price (which it has long argued is under-valued). It is obliged to cooperate with the investigation, and report material developments to the New York Stock Exchange.

This case has been compared to the Chinese government’s anti-trust sanctions and fines placed on other internet economy giants, such as Alibaba and Meituan, in 2021.

Although Chinese state media noted that this investigation is “in line with broader regulatory efforts targeting monopolistic practices by online platforms,” it’s wise to assess the case on its own terms.

The timing?

Some coverage has referenced the investigation commencing a month before Chinese New Year, one of China’s largest travel booking periods.

That should be regarded as immaterial.

The investigation is being conducted at the start of the year because the company’s 2025 financial report is currently being prepared and audited. Based on previous cases, any fine levied would be calculated based on the 2025 financial performance.

How long will the investigation take?

Again, this is hard to determine.

However, the SAMR will be aware that upon publication of its full-year financial results, Trip.com undertakes an annual earnings call - during which its Co-Founder/Executive Chairman, CEO and CFO answer questions from analysts.

Last year, that call was on 24 February.

Thaijapan 2: The Sequel

Readers with a long memory will recall that Issue 115 (30/07/2023) was entitled Forget Barbenheimer, Asia Pacific’s Travel Box Office Battle is Thaijapan. It tracked the developing rivalry between Thailand and Japan to attract more tourists than the other.

Japan marched ahead in that battle by passing the 40 million milestone for the first time in 2025, compared to Thailand’s 32.9 million.

Within 1 month, however, both countries could have new governments bringing new policies to boost tourism.

Thailand has already announced that its national election - which is likely to be tense and contentious - will take place on 8 February.

Meanwhile, speculation is rising that Japan’s new Prime Minister Sanae Takaichi will dissolve parliament next week and call a snap election.

8 February.

The Philippines waives visas for Chinese visitors. Why now?

And, finally to the Philippines, where the government this week approved 14-day visa-free entry for Chinese tourists (flying into Manila or Cebu).

This may seem surprising given the fractious relations between the 2 countries, the frequent maritime clashes - and the nation’s post-Covid reluctance to waive visas.

The reasoning is simple: Tourism Diplomacy.

In 2026, the Philippines is Chair of ASEAN, and will host various Ministerial Summits (and the ASEAN Tourism Forum) in which Chinese delegations will be involved.

In today’s geopolitical era, it would be implausible for the ASEAN Chair nation to not provide visa waivers to Chinese tourists.

And, that’s a wrap for Issue 215.

Asia Travel Re:Set will return next Sunday.

Happy travels….

Gary