Issue #185: 5 Chinese Golden Week Travel & Tourism Stories You May Have Missed

China focuses on domestic and inbound tourism, while Thailand confronts "a crisis"

Welcome to Issue 185 of Asia Travel Re:Set.

Am back in KL after a frenetic few days at the Arabian Travel Market in Dubai. The levels of travel and tourism investment across the GCC region are eye-opening.

Next stop: Bangkok for the TDM Travel Trade Global Summit 2025 on Thursday.

I’ll be moderating the Rethinking ASEAN & APAC Travel Markets in 2025 and Beyond panel with Patee Sarasin, CEO, Really Cool Airlines and Deepshikha Sehgal, Head of Lodging, Ground & Sea APAC, Sabre. Looking forward to that!

Meantime, the May Labour Day Holiday is generating headlines in China.

So, let’s follow that train of thought.

Thanks for checking in…

Enjoyed speaking on How Will US Tariffs Impact Travel & Tourism in ASEAN & APAC? at the two-day MG Connect: Leadership Series event in Kuala Lumpur on 23/24 April. Many thanks for Brett Henry and Jessica Dwita for the kind invitation.

How are Middle East destinations optimising surging tourism interest from key Asian markets, China and India, plus Japan, South Korea and South East Asia? A fascinating panel session at Arabian Travel Market with Alhasan Aldabbagh, Saudi Tourism Authority; Shahab Shayan, Dubai Department of Economy & Tourism and Boon Sian Chai, Trip.com, expertly curated and moderated by Mingjie Wang, China Daily.

5 Chinese Golden Week Travel & Tourism Stories You May Have Missed

There were 3 Golden Weeks when I lived in China during the 2000s: Spring Festival, May Labour Day and October National Day.

Governmentally approved in 1999, these week-long public holidays provided people with mandatory paid leave, which could be used to travel and consume.

In the 2000s, China’s outbound travel revolution was nascent, while domestic tourism was starting to boom. In 2008, the government shortened the length of the May Golden Week, and added those days to other mini holidays. This created 2 Golden weeks plus a handful of 3 to 5-day public holidays distributed across the calendar.

It was widely assumed that shortening the May Golden Week and enhancing other long-weekend breaks was intended to encourage more domestic travel, and concentrate outbound travel on the 2 pillar Golden Weeks in Jan/Feb and October.

This year, Chinese state media has endeavoured to highlight inbound tourism - which it did not do pre-Covid - from regional markets to supplement domestic spending. The long-weekend South Korean inbound market to Shanghai is an especially hot trend to watch in 2025.

In this context, outbound travel has fallen further down the governmental ladder of importance.

1) Chinese airlines’ pre-Covid profits are now consistent losses

Source: Reuters

After posting 5 consecutive years of losses from 2020-2024 - an outcome of the 3-year Covid international travel lockout - China’s Big 3 airlines endured a grim Q1 of 2025. With domestic air travel growth slowing and one-fifth of the 2019 international air market still absent, China Southern, China Eastern and Air China reported Q1 operating losses of between RMB69 million and RMB2.5 billion. Meantime, Xi’an-based carrier Joy Air suspended all flights citing “operational difficulties.”

2) Tariffs, air transport disruption & Boeing

China’s Ministry of Commerce made a blistering reference to US tariffs in responding to reports that Chinese airlines had returned 3 Boeing 737 MAX aircraft. “The US reckless use of tariffs as a weapon has severely disrupted global industrial and supply chains and destabilized the international air transport market. Many companies are unable to conduct normal trade and investment activities, with both Chinese airlines and Boeing suffering significant harm.”

The statement added, pointedly, “More than 10,000 Boeing airplanes are flying with China-made parts, according to Boeing's own analysis published in August 2024”.

3) “3-6 Years” for COMAC certification in Europe

While China’s COMAC C909 planes are gaining gradual traction in South East Asia, the primary goal is to achieve US and EU air regulator certification for the larger, longer-range C919 narrow-body. This would make it a globally sellable commodity. However, the process in the EU will take up to 6 years, according to comments this week by Florian Guillermet, Executive Director of the European Union Aviation Safety Agency (EASA). There has been no similar guidance from the US air regulator.

4) 144 million rail trips

While its major airlines are making eye-watering losses, China’s (admittedly debt-heavy) railways are pulsing. China’s rail network handled 23.12 million passenger trips in a single day on Thursday, the start of the May Labour Day holiday. This was up 11.7% year on year. China’s State Railway forecasts 144 million passengers (equivalent to the population of Russia) across the full 8-day holiday travel period.

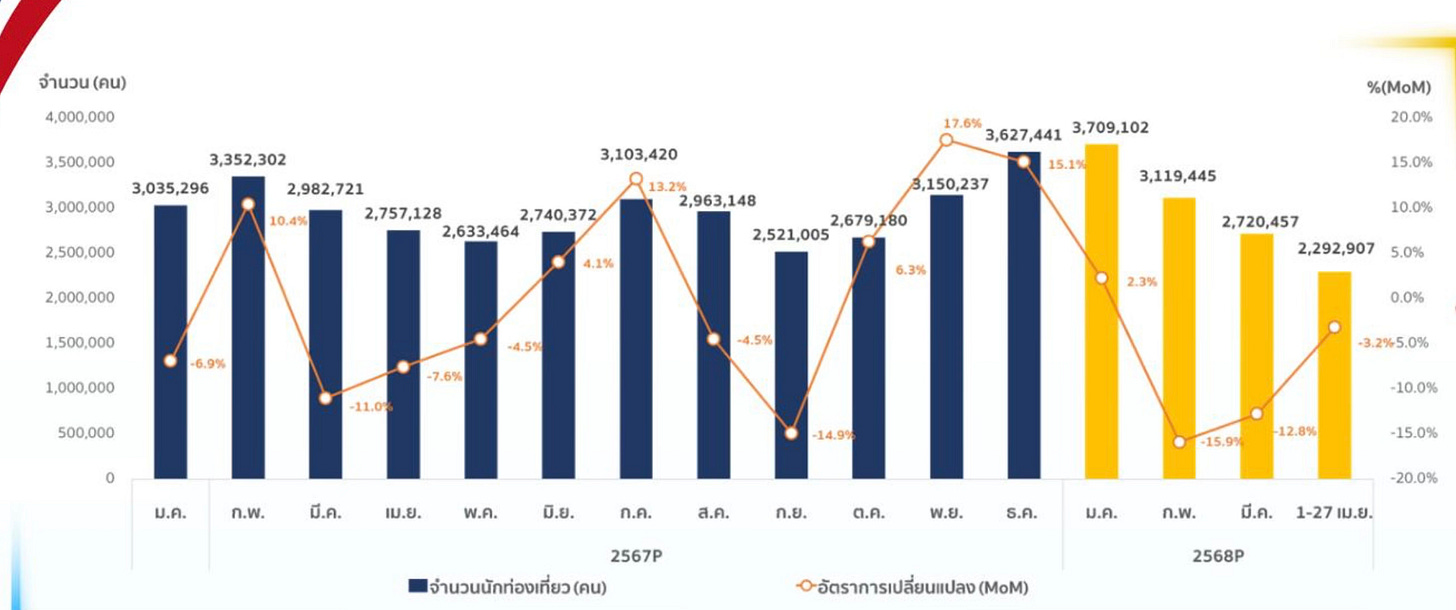

Source: Thailand Ministry of Tourism & Sports

5) “Thailand faces tourism crisis as foreign arrivals stagnate”

That was a headline in The Nation this week as Thailand cut its annual visitor forecast from 38.5 million to 36.5 million. The Minister of Tourism & Sports, Sorawong Thienthong, gathered the heads of the Association of Thai Travel Agents, the Thai Hotels Association, the Tourism Council of Thailand and the Airlines Association of Thailand to collectively “act wherever we can" to rebuild confidence in Thai tourism, which “remains the only strong engine driving our economy right now.” Of the 11.84 million visitors to Thailand so far this year, 1.6 million are from China, but the 2025 target range of 7.2-7.5 million looks a long shot.

The diagram above shows the monthly arrivals to Thailand in 2024 (blue) and 2025 in yellow. While January 2025 marked a year-on-year increase, visitor arrivals were lower in February, March and April compared to the corresponding 2024 month.

And, that’s a wrap for Issue 185.

Asia Travel Re:Set will be back next Sunday. Meantime, find me on LinkedIn.

Happy travels,

Gary