Issue #176: The Tourism Outlook Between Australia, South East Asia, China & India

What's the state of play for Australia's visitor economy three years after reopening?

Welcome to Issue 176 of Asia Travel Re:Set.

Five years ago on Tuesday (11 March 2020), the WHO declared a global pandemic.

Almost exactly 3 years ago (6 March 2022), Issue #74 of this newsletter was titled: Australia Reopens & Targets ASEAN Inbound Markets.

It was subtitled, Can South East Asia's "Rising Stars" help rebuild Australia's tourism economy?

So, let’s bring that train of thought up to date.

Thanks for checking in…

If you’re attending the 2025 Short Stay Summit in London, on 2 April, see you there!

I look forward to taking part in the Focus on China panel session with Andy Washington, General Manager, Europe, and Bo Xian Ye, VP, Alternative Accommodation, both of Trip.com, Ada Xu, Director of International Affairs of Fliggy, and Helena Beard, Managing Director of Guanxi.

Tourism taxes are a hot topic. Thailand has revealed that its (twice-scrapped) THB300 tourism tax will enter into force this year. New Zealand launched a visitor levy in 2019 and tripled it in 2024. Bali imposed an entry fee in 2024, and Japan could raise its departure tax. So what happens next? I enjoyed joining Andrea Heng and Hairianto Diman for The Morning Report on Singapore’s CNA983 to assess the various purposes and mechanisms for taxing tourists, and the outlook for tourism pricing across Asia.

Click HERE to listen to Tourism tax: The effectiveness on tourism figures

The Tourism Outlook Between Australia, South East Asia, China & India

It’s a little more than 3 years since Australia reopened after the pandemic, on 21 February 2022. The visitor economy is now seeing diversifying patterns of demand, air supply, visitor spending and travel sector investment. So, what happens next?

On this week’s The South East Asia Travel Show, I discussed Australia’s complex and shifting tourism dynamics with Garrett Tyler-Parker, Director of Analysis & Insights at Tourism Research Australia.

Here are 6 brief pointers from our discussion, and - as ever - the full reveal comes from listening to the podcast.

1) “There are a lot of good factors for the Chinese market in future years”

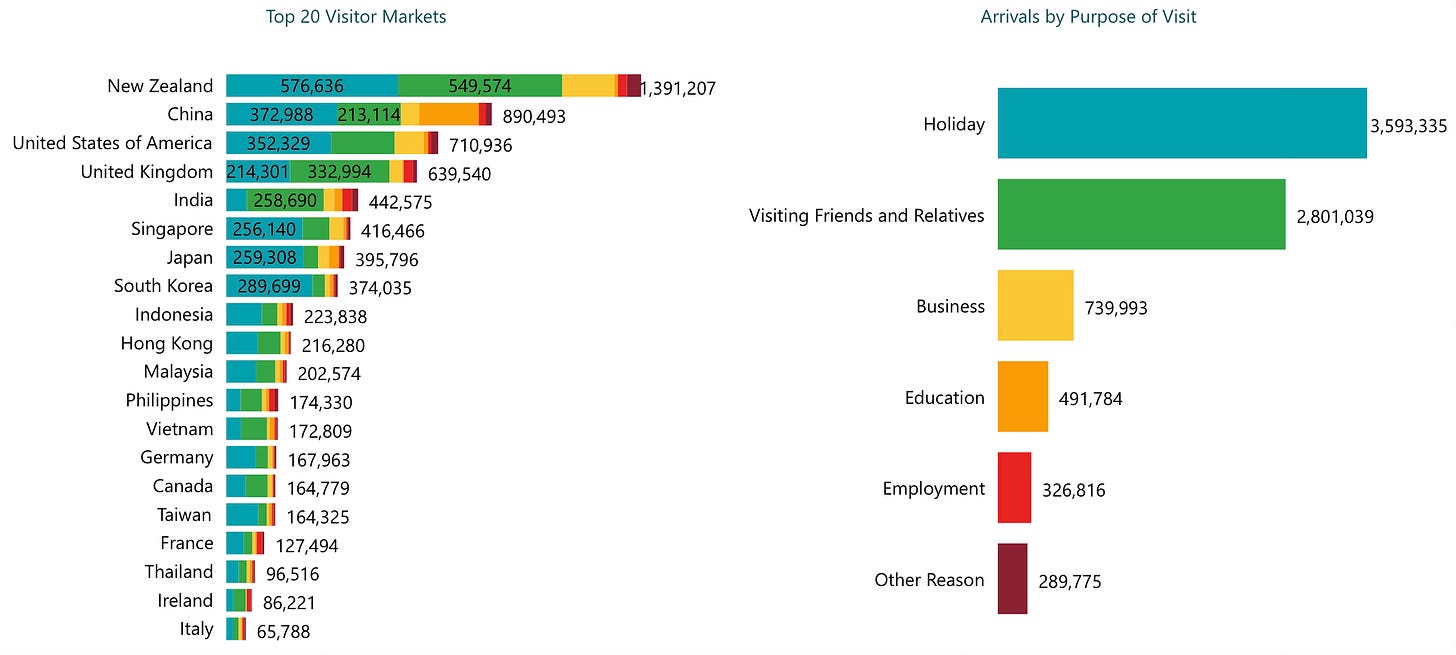

In 2018-19, China accelerated to become Australia’s number 1 inbound market, overtaking New Zealand, which was the long-time top arrivals source. Recovery growth from China slowed “more than forecast” in 2024 compared to 2023, but…“China is coming back. It’s already at the number 2 position, and while we don’t expect it to hit the pre-Covid levels until 2027, it is far ahead of the US in 3rd.”

2) “By the end of 2023, India was already at 99% of pre-pandemic visitors, and spend was way higher”

Indian arrivals to Australia are around half of the total from China, but vibrant growth is anticipated. India leapt from the 7th largest inbound market in 2019 to 5th in 2024. The post-Covid recovery surge has slowed. Nevertheless, “there’s a huge Indian diaspora in Australia, and there are many factors that will keep driving visitor growth from India.”

3) “India’s arrivals growth to Australia is forecast at 7%. China 14%. South East Asia 45%”

Six ASEAN nations - Singapore (6th), Indonesia (9th), Malaysia (11th), the Philippines (12th), Vietnam (13th) and Thailand (18th) - ranked among Australia’s top 20 visitor markets in 2024. In 2019, those 6 markets were roughly equal to China in terms of annual visitors. In 2024, 3 of those markets, Singapore, Indonesia and Malaysia, were pretty much equivalent to China. “The relative importance of the South East Asian market is growing.” Vietnam, Indonesia and Philippines have surpassed 2019 visitor levels. Thailand is around 96%. Malaysia’s recovery rate has been much slower, though.

Source: Australian Bureau of Statistics

4) “20 different tourism indicators across 4 pillars”

Tourism Research Australia has broadened its analytical scope to gain a “more complete picture” of the visitor economy. In late 2024, it launched a live Longitudinal Indicators dashboard measuring “social, environmental and institutional factors, alongside the more traditional economic considerations.”

5) “For international visitors, there are a couple of interesting areas around experiences”

Australia is witnessing “much higher levels of engagement for First Nations’ cultural activities.” Visitors on holiday and VFR are also increasingly interested in outdoor and nature activities, “but the biggest increase in outdoor and nature activities is coming from people visiting Australia for business and education.”

6) “Investment is a good forward-looking indicator of business confidence in the travel sector”

Last week, Australia published its Tourism Monitor 2023-24, which recorded 346 tourism investment pipeline projects, with a total value of AUD63.4 billion. This marks an increase of 39 projects totalling AUD7.3 billion from 2022-23. Aviation comprises over one-third (AUD23.1 billion) of under-construction, planned and proposed projects, including 3 “major projects”: Western Sydney International Airport, Koo Wee Rup Airport near Melbourne, and a Qantas terminal at Perth Airport.

Click the live link below to listen to The Tourism Outlook Between Australia, South East Asia, China & India…

Or search for The South East Asia Travel Show on any podcast app.

And, that’s a wrap for this week.

Asia Travel Re:Set will return next Sunday. Meantime, catch me on LinkedIn - and check out our new High-Yield Tourism website.

Happy travels,

Gary