Issue #175: South East Asia's Top 8 Travel & Tourism Takeaways in February

Hot travel takes from Indonesia, Malaysia, Thailand, the Philippines, China & India

Welcome to Issue 175 of Asia Travel Re:Set.

So where did February go?

Already, we are 2 months into 2025, and what a fascinating month it proved to be for travel developments in South East Asia.

So, let’s follow that train of thought - by looking back and forth…

Thanks for checking in…

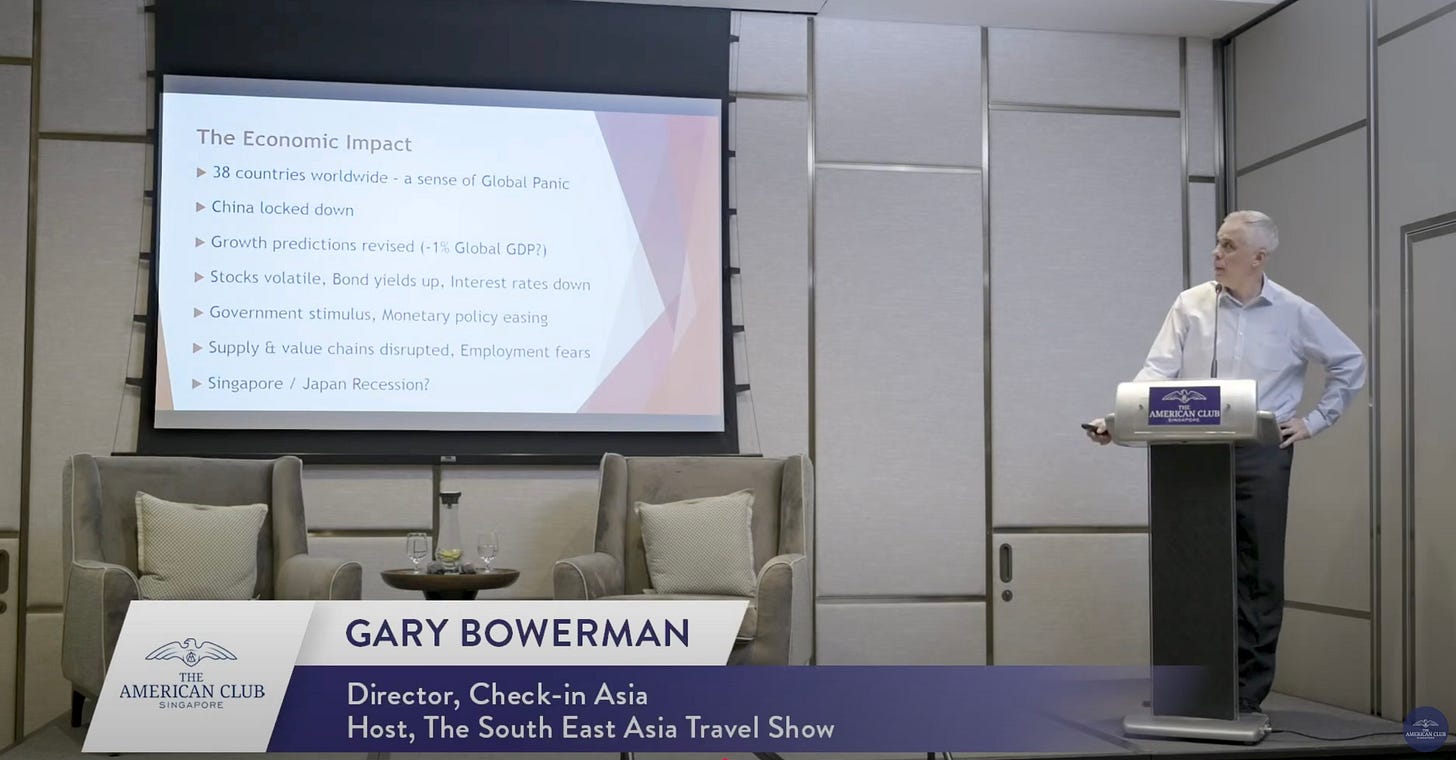

5. Years. Ago. On 26 February 2020, Dr Piotr Chlebicki and I hosted a seminar, What Will be the Economic Impacts of Covid-19? at the The American Club Singapore.

Dr Piotr (an infectious diseases expert) assessed - in the context of a still-nascent epidemic - the medical outlook, and I analysed the potential economic and political ramifications, and the consequences for the travel economy in Asia.

I will never forget the looks on faces in the audience when Dr Piotr described it as "the perfect virus" because of its ability to mutate and spread quickly.

We both predicted a long, protracted Covid experience across the region, which would involve a limitation of personal freedoms and the ability to travel.

Neither of us forecast those impacts would last for 2 years in South East Asia, 2.5 years in much of North East Asia and almost 3 years in China.

My clear takeaway from that night are 2 questions from the floor:

Will I be able to take my mother on a pre-booked trip to see family in the US?

Will the 2020 Tokyo Olympics take place?

Our answer to both was, "Sadly, No".

A video of the seminar is still available. See here:

South East Asia’s Top 8 Travel & Tourism Takeaways in February

The 2nd month of 2025 threw up some compelling regional stories. So, as we do each month on The South East Asia Travel Show, we reviewed the Top 8 talking points.

Here are some brief pointers from our in-depth discussion, and - as ever - the full reveal comes from listening to the podcast.

1) Asia’s ‘Tourism Space Race’ Intensifies

Thailand and Japan are locked in a battle to become the first Asian nation to welcome 40 million visitors in a single year. Both got off to a flyer in January. Thailand greeted 3.71 million arrivals. This was bettered by Japan’s monthly record of 3.78 million, including a staggering 980,300 visitors from China.

2) Indonesia Cuts Tourism Budget

Stringent austerity measures across government departments in Indonesia will have 2 impacts on travel. Firstly, the national tourism marketing budget will be cut, meaning Indonesia is unlikely to be present at major travel shows this year. Secondly, and most pertinently, it will remove a significant volume of flights and hotel stays by government officials from the domestic economy.

3) Malaysia’s 1st State-owned Airline

The state government of Sarawak has acquired MASWings, a regional carrier and part of the Malaysia Airlines Group. MASWings will become, later in 2025, AirBorneo, and will operate routes between Indonesia, Brunei and Malaysia (which share the island of Borneo). The mid-term aim is to serve destinations in ASEAN and North East Asia.

4) Thailand Reviews 53-year Alcohol Ban

Having extended opening hours to enable entertainment venues to serve alcohol until 4am, the Thai government is zoning in on the nation’s afternoon booze ban. Since 1972, it has been illegal to purchase alcohol anywhere in Thailand between 2pm and 5pm. A review of the law is under way.

5) Michelin Guide Launches in the Philippines

Last June (#147 - Framing Gastronomy as a Driver of Tourism Growth in the Philippines), I attended the 1st UN Tourism Forum on Gastronomy Tourism for Asia Pacific in Cebu. The Philippines’ Secretary of Tourism, Christina Frasco, unveiled plans to leverage food tourism “for the growth of various sectors of the economy.” The latest move to place the nation on “the global culinary map” will bring the Michelin restaurant guide to the Philippines in 2026.

6) Visa-free ASEAN Tours to Xishuangbanna

Over the past 16 months, China has introduced visa-free access for visitors from almost 40 nations (with more to come), alongside enhanced visa-free entry to Hainan Island. Taking a regional theme, tour groups from ASEAN nations can now visit Xishuangbanna in beautiful Yunnan province without a visa for up to 6 days.

7) Langkawi vs Phuket

Langkawi is Malaysia’s premier resort island, located near the border with Thailand. It continues to under-perform in tourism terms. Langkawi, which counts a land mass of 479 sq km, attracted 2.9 million visitors in 2024. Malaysia often compares Langkawi to Phuket but that can be less than favourable. Phuket, which has a land mass of 543 sq km, attracted 13.1 million tourists in 2024.

8) India Focus in ASEAN

Last week’s South Asia Travel & Tourism Exchange (SATTE) in Delhi saw ASEAN tourism marketers court India’s travel trade. Singapore wants a liberalised bilateral air service agreement with India, Malaysia aims to expand flight connectivity with the cities of Hyderabad, Bengaluru and Kochi, and the Philippines plans to launch a direct Delhi-Manila flight. India-ASEAN supply expansion will be a theme of 2025.

Click the live link below to listen to Indonesia’s Tourism Budget Bust, Malaysia’s New State Airline & the Philippines Goes Michelin: February 2025 in Review…

Or search for The South East Asia Travel Show on any podcast app.

And, that’s a wrap for this week.

Asia Travel Re:Set will return next Sunday. Meantime, catch me on LinkedIn - and check out our new High-Yield Tourism website.

Happy travels,

Gary

Hi Gary, it is great to find a stack on Asia like yours.