Issue #173: The 8 Top Chinese Outbound Tourism Topics to Watch in 2025

Consumer demand in China's outbound travel market will continue to fragment.

Welcome to Issue 173 of Asia Travel Re:Set.

If you are in any doubt, 2025’s hottest topic in Asia Pacific will be China Outbound.

After 2 gradual recovery years, 2025 will bring more tourists and diversified trends.

So, what did we learn from the recent Chinese New Year holiday?

Let’s follow that train of thought with my guest this week, Sienna Parulis-Cook of Beijing-based Dragon Trail International.

Thanks for checking in…

The 8 Top Chinese Outbound Tourism Topics to Watch in 2025

The 3rd year since China reopened for travel promises to be very different to 2024 - which was itself very different to 2023 - and a world away from 2019.

So, what happens next?

On this week’s The South East Asia Travel Show, I chatted with Sienna Parulis-Cook, of Beijing-based Dragon Trail International, to assess the top takeaways from Chinese New Year - the most important Golden Week for travel - and what they tell us about the Chinese outbound outlook for 2025.

Here are a few brief pointers from our in-depth discussion, and - as ever - the full reveal comes from listening to the podcast.

1. Fragmentation, Fragmentation, Fragmentation

“In 2025, consumer demand in the outbound travel market in China will continue to fragment, particularly in terms of interests. This shift is one of the most significant changes brought about by the COVID-19 pandemic.”

Two years after reopening, some things look similar to before, such as the dominance of South East Asian destinations, Japan and South Korea. But look closely, and the Chinese outbound travel market is realigning, reshaping and, crucially, fragmenting. This will be 2025’s dominant theme.

2. Top CNY Takeaways

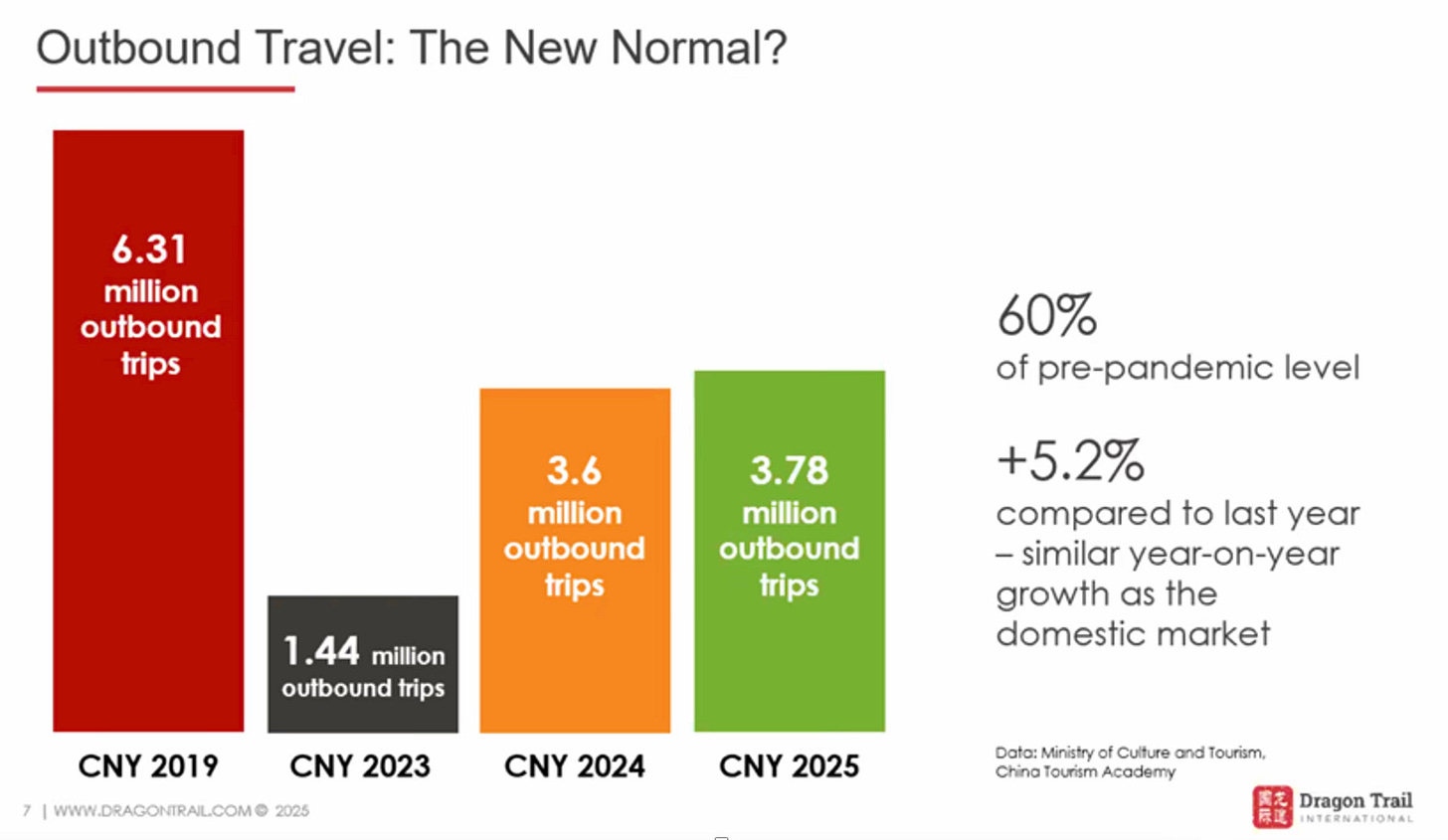

Comparisons with 2019 are obvious, but should be tempered. Overall, CNY outbound growth is moderating, and this may apply across the calendar. But the macro picture masks fomenting sub-surface trends. Keep an eye on Saudi Arabia, Hungary, Norway, Japan. Watch niche segments gain traction (self-drive, family travel), and assess each nation as its own market, not part of an ever-more meaningless global aggregation.

3. Malaysia Heads the South East Asia Rebound

Malaysia’s flight connectivity with China was up over 20% versus 2019. This is largely attributed to the resurgence of AirAsia, which connects more than 30 cities in China, and has also added some intriguing new routes to diversify supply and demand. Keep an eye on Vietnam, too. Its January Chinese arrivals stats were compelling.

4. Thailand: Glass Half Full & Half Empty

The pre-CNY period was dominated by the Wang Xing kidnapping, scam centres on the Thai-Myanmar border, booking cancellations - and Thai PM Shinawatra’s plaintive AI video post addressing Chinese tourists. Personal safety is an issue for the Thai tourism sector. So, too, is air quality. But just look at the numbers. Some 825,617 Chinese arrivals from 1 January- 9 February. That is, by any measure, a huge total.

Click the live link below to listen to Fragmentation is the New Normal: The Top 8 Chinese Outbound Tourism Topics to Watch in 2025…

Or search for The South East Asia Travel Show on any podcast app.

5. Japan is a Juggernaut

Geographical proximity, a reputation for safety and security, highly desirable cuisines and a depth and breath of landscapes and cultural experiences unmatched in Asia Pacific. A cheap Yen. Excellent flight connectivity with cities in eastern and northern China. These are among the pull factors for Chinese tourists to Japan. Seasonality is also a trend to watch: CNY saw strong growth in bookings for snowy Hokkaido.

6. Northern Lights in Europe

Central and Eastern European nations are on track for growth in Chinese arrivals this year - Hungary and Serbia are hotspots to monitor. Northern European destinations, especially Norway and Iceland, are expected to benefit from 2025’s forecast of being a good year to observe the Northern Lights.

7. Self-driving Tourism is the Hot Trend

Not a new topic, but an accelerating trend. I’ve covered Chinese self-drive travel a few times (EV Tourism Take-off in China, Laos & Beyond; Chinese EVs Take on Global Tourism; Self-drive Trips Rev up as Chinese Tourists Take off Again; and Tracking the Top Trends in Chinese Outbound Tourism for 2025) in recent years. In 2025, it will go mainstream.

8. Market Growth to Track GDP?

Patterns of growth appear to be moderating. Outbound tourism bookings were up 5.2% for CNY, which tracks China’s GDP growth in 2024. Domestic travel growth was slightly higher, 5.9%. The dynamic annual expansion rates of a decade ago are not expected to return any time soon. BUT, the Chinese market WILL continue to grow.

And, that’s a wrap for this week’s newsletter.

Asia Travel Re:Set will return next Sunday. Meantime, catch me on LinkedIn.

Happy travels,

Gary