Issue #159: "We're Betting Big on China!"

A potpourri of October Golden Week comments, statistics and WeChat moments...

Welcome to Issue 159 of Asia Travel Re:Set.

I wasn’t planning on returning to China’s October Golden Week today, but the statistics and insights were fascinating.

We discussed these in detail on The South East Asia Travel Show.

So let’s follow that train of thought…

Thanks for checking in.

If you’ll be heading to ITB Asia in Singapore (23-25 October), see you there! I’ll be moderating the Tours & Destination Leaders' Panel, which will discuss "Shaping the Future of Unforgettable Experiences" with a stellar line-up. Click HERE to find out more.

I was one of the 49 industry specialists interviewed by Canvas8 for its 2025 Expert Outlook. Advising on the Travel & Leisure sector in Asia Pacific, I talked about the concept of 'Me First' within the context of the report’s focus on “the hyper-individualistic consumer". Payments are a hot topic across the regional travel and lifestyle sphere, and solvable bottlenecks require unblocking. Click HERE to request your copy of the report.

"We're Betting Big on China!"

A potpourri of October Golden Week comments, statistics and WeChat moments...

765 million. The official total of domestic tourism trips during Golden Week, from 1-7 October, up 10.2% versus 2019.

13.1 million. Total “entries and exits” by Chinese and foreign nationals.

17.74 million. The average number of domestic rail passengers in China.

Let’s keep those stats in mind as we continue…

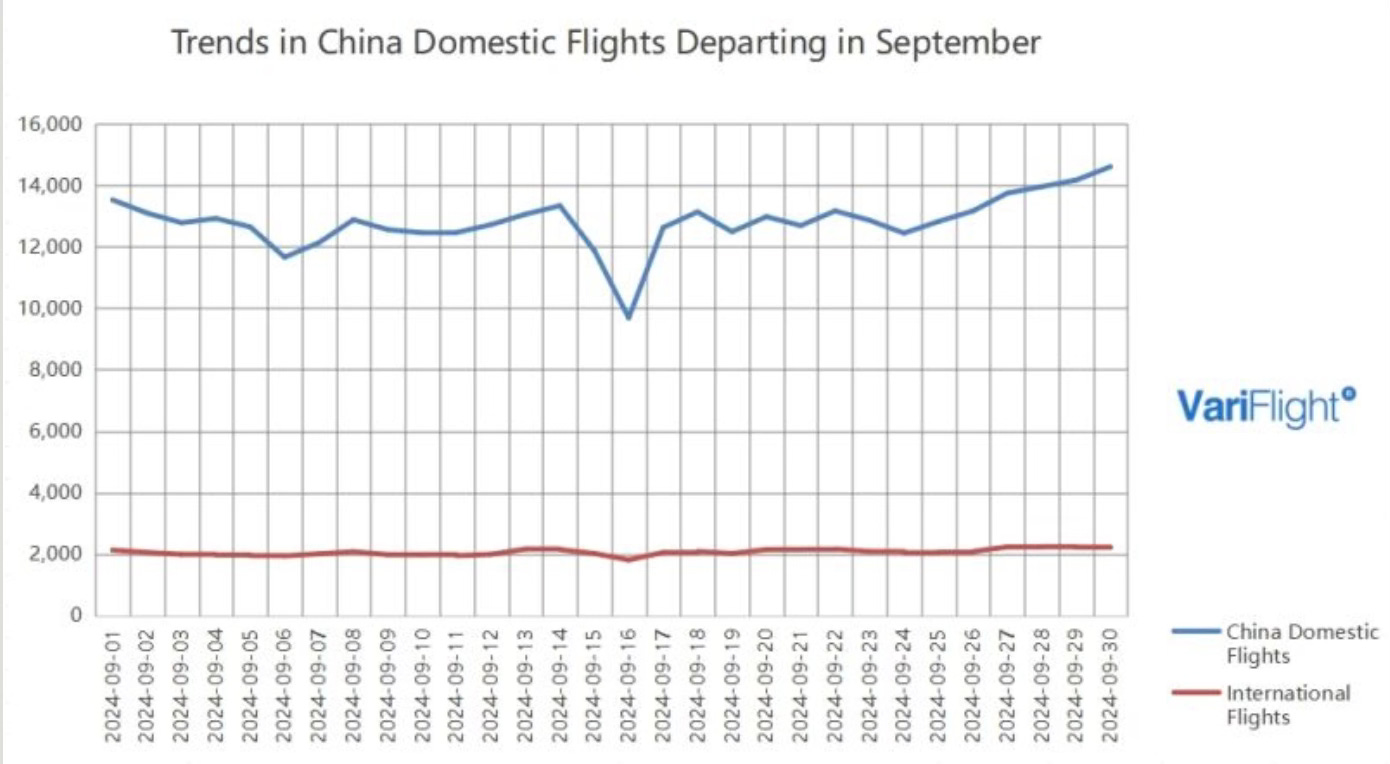

Here’s my favourite graphic of the week, courtesy of VariFlight, which paints an intriguing storyline of Chinese domestic and international flights over the month leading up to Golden Week…

Interesting “Tourism Deficit” report from the South China Morning Post. Hong Kong received 1.2 million mainland Chinese visitors during Golden Week, while Hong Kongers made 1.78 million outbound trips.

Right, next to the subject of this week’s newsletter headline…

“We are betting big on China… What we are seeing at the moment is short term. There’s no doubt that the growth is going to be exponential… China is still on track to be the biggest tourism market in the world in the next 10 years.”

Those were the bullish words this week of Gary Rosen, CEO of Accor in Greater China, in the above interview with Bloomberg. He was referencing that Golden Week saw impressive hotel occupancies but visitor spending was still constrained – and room rates reflected that.

And he revealed a great stat. The average booking time in China for Accor (which has over 700 hotels in Greater China) is…. “less than 48 hours.”

Well worth a watch.

Weak Consumer Spending Priced in

Which brings us to a fascinating chat I had this week with Sienna Parulis-Cook, Director of Marketing & Communications for Beijing-based Dragon Trail International on The South East Asia Travel Show.

Sienna and I deconstructed the key Golden Week data and trends for Chinese tourists in South East Asia, North East Asia, Europe, Middle East and Africa (more below).

It’s clear that many destinations enjoyed their most optimistic Chinese Golden Week since the corresponding period way back in 2019. There are still challenges, though, notably the pricing in of weak consumer spending.

This was confirmed by Chinese OTA Fliggy, which noted:

“Average domestic flight and hotel bookings [cost] decreased by approximately 13% and 6%, respectively, compared to last year, while international flight and hotel bookings [cost] fell by about 19% and 3%.”

Self-Drive Trips & Itinerary Control

Long-time readers of this newsletter will know that I view self-drive travel as an important barometer of change in Chinese tourism (See: Chinese EVs take on global tourism and Self-drive trips rev up as Chinese tourists take off again). Taking a driving trip enables tourists to create and manage their own itinerary - whether in China or overseas - and this is driving new patterns of travel experience searching.

Intriguing data insights from China’s leading (outbound and domestic) self-drive platform Zuzuche. Its Golden Week Self-Driving Report reveals an increase of 32% for outbound car rentals compared to October Golden Week 2023.

The Top 10 destinations for car rentals by Chinese travellers were: US, New Zealand, Italy, Australia, Norway, Spain, Turkey, Switzerland, France and UK. “Emerging hotspots” included Reykjavik, Zagreb, Mallorca, Riyadh, Tbilisi, and the Faroe Islands.

Japan to Hawaii, Arizona to Indonesia

And so to my favourite quote from this week’s podcast chat with Dragon Trail International’s Sienna Parulis-Cook (see below). Referencing an issue raised in last week’s newsletter, I asked whether the value of Golden Week remains as high as before Covid. Here’s part of Sienna’s reply:

“This is always my favourite time of year to look at my WeChat Moments feed. Before Covid, you’d get to see travel pictures by your connections from across the continents during October Golden Week. Then that didn’t happen during the pandemic. Yesterday, I was scrolling and saw posts from Japan, and Arizona, and Hawaii, and Indonesia - not to mention lots of posts from travelling around China. It feels good to see that again.”

How did China's recent Golden Week pan out for tourism destinations in Asia, Europe, and further afield? Are Golden Week holidays still an accurate measure of Chinese outbound tourism?

Plus, why is Japan so popular with Chinese tourists? Where are the emerging hotspots in the Middle East and Africa? How should we interpret the data from China’s top OTAs and niche booking platforms?

And how is red-hot travel and lifestyle app Xiaohongshu reshaping experience seeking?

Listen to Sienna and I discuss these issues, and much more, on "Deconstructing China's October Golden Week in Asia Pacific & Beyond", here:

Or search for The South East Asia Travel Show on any international podcast app.

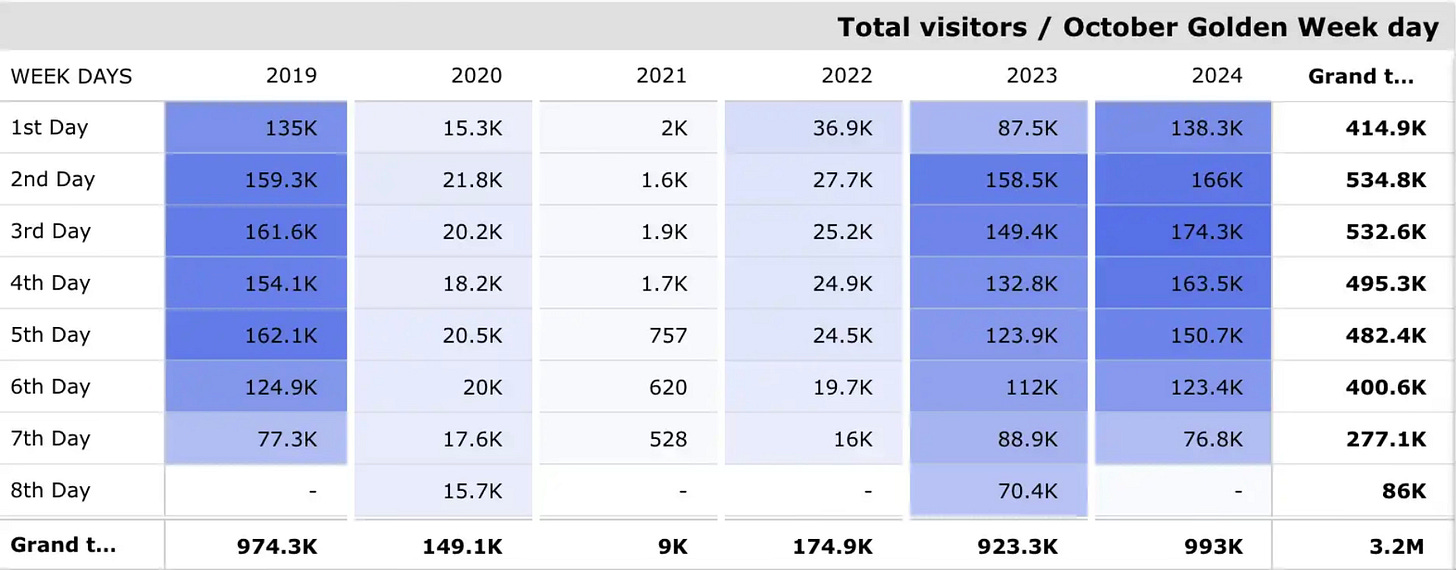

And finally… file the below under “This is how bad it really got during Covid.”

Provisional data from the Macao Government Tourism Office shows that over the 7 days of the 2024 October Golden Week (NB: an 8th day was added in 2023), Macau received 993,000 visitors - of which 826,000 were from Mainland China, and 117,000 from Hong Kong.

But check out that 2021 total: 9,000.

And, that’s a wrap for issue 159.

Asia Travel Re:Set will return next Sunday.

Meanwhile, find me at LinkedIn, The South East Asia Travel Show and High-Yield Tourism.

Happy travels,

Gary