Issue #142 - This Week's Top 8 Travel & Tourism Talking Points in… Asia Pacific!

What's new in China, Japan, South Korea, Australia, Cambodia, and more?

Welcome to issue 142 of Asia Travel Re:Set.

I spent the past 2 weeks observing travel trends in Spain as the 2024 peak season kicks into gear. Barcelona and Madrid are already drawing big visitor numbers. It’s going to be a busy, and - given some of the anti-tourism graffiti I spotted - polarising summer.

Meanwhile, it was a week of travel reports, forecasts and policy plans in Asia Pacific.

So, let’s follow that train of thought…

Thanks for checking-in.

- “IN THE NEWS”

- This Week's Top 8 Travel & Tourism Talking Points in Asia Pacific!

What’s new in China, Japan, South Korea, Australia, Cambodia, and more?

- Beyond the Circus: Cambodia’s Tourism Recovery

In conversation with Craig Dodge of Phare, the Cambodian Circus.

“IN THE NEWS”

What connects Lisa from Blackpink with Shanghai, and Taylor Swift with Jay Chou? What associated Melbourne, Bangkok and Phuket during Spring Festival? How is ShakeShack aligned to the HalalTrip Gastronomy Awards? What bonds Jakarta with Beijing, Seoul, Tokyo and Taipei? And what links the Gregorian calendar with Wong Kar-wai, Hotel 101, Xiaomi, and Singapore’s average daily hotel rate?

The answers to these questions - snd many more - featured in my Closing Keynote, Asia Pacific's Hot Travel Trends: Why They Matter to Global Travel & Tourism - at Worldline’s Rise Travel 2024 conference in beautiful Barcelona.

China. Japan. South Korea. Hong Kong. Taiwan. Rewind to 2019, and these inter-connected air markets shared dynamic travel flows. Then came the Great Disconnect. So, how are North East Asia’s supply and demand patterns reshaping?

Enjoyed joining John Grant, Deirdre Fulton and Prof. Dr. Wolfgang Georg Arlt on this month's OAG Webinar for a fascinating, data-driven discussion about North East Asia: Growth & Recovery. Catch the recording HERE.

This Week's Top 8 Travel & Tourism Talking Points in Asia Pacific!

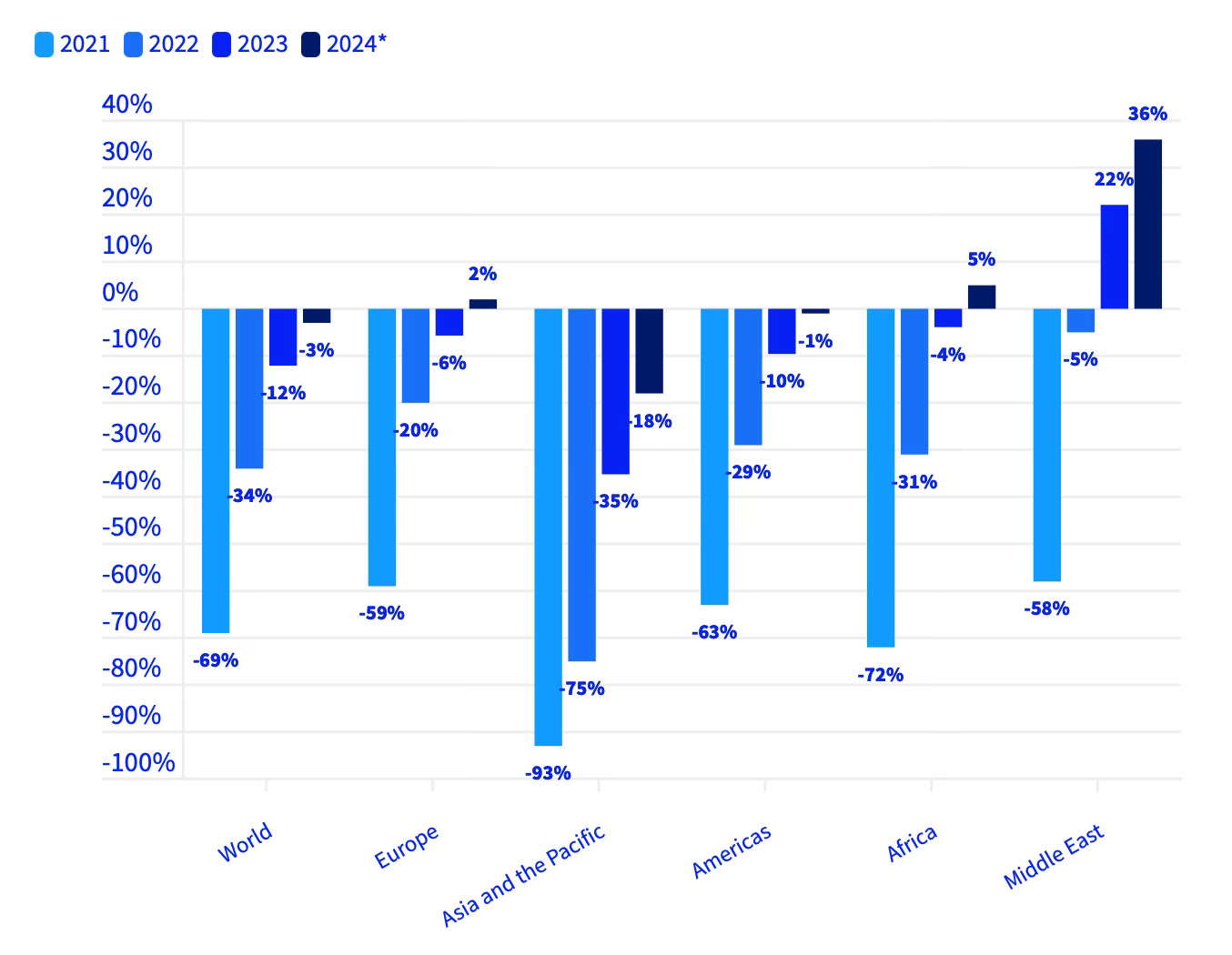

Source: UN Tourism (International Tourist Arrivals, World and Regions, May 2024)

Firstly, thoughts go out to the 229 passengers and crew impacted by “sudden, extreme turbulence” on flight SQ321 from London-Singapore. The plane made an emergency landing in Bangkok after the incident over Myanmar. One person died, while 48 people are still being treated at Bangkok hospitals for spinal, skull and brain injuries.

Next to UN Tourism’s latest update (see above), which showed that “international tourism reached 97% of pre-pandemic levels” in Q1 2024. An estimated 285 million international travellers in the first 3 months of 2024 was up “about 20%” year-on-year. Middle East led the way for comparative growth, while “arrivals in Asia Pacific recovered 82% of pre-pandemic levels in Q1 2024, after recovering 65% in 2023.”

Next to Mastercard’s Travel Trends 2024 report, which noted “APAC destinations comprise half of the top 10 hotspots that have demonstrated the greatest momentum among travellers”. This is measured by the “change in share of tourism transactions over the past 12 months ending March 2024”. Unsurprisingly, Japan placed #1, followed by Malaysia (#6), Australia (#7), South Korea (#8) and Indonesia (#10).

On to the World Economic Forum’s Travel & Tourism Development Index 2024, which “explores the state of the recovery from the pandemic amid an increasingly complex operating landscape.” Out of the top 30 TTDI scorers in 2024, 19 are in Europe, 7 in Asia Pacific, 3 in the Americas and 1 in the Middle East & North Africa. The top 10 are US, Spain, Japan, France, Australia, Germany, UK, China, Italy and Switzerland.

Governmental direction of tourism in Asian markets is a theme I’ve been discussing a lot lately at conferences and in interviews and podcasts. Before Xi Jinping’s famous “500 million outbound visits” speech in 2015, Chinese leaders didn’t publicly discuss tourism. This week, President Xi exhorted all China’s regions and departments “to coordinate the implementation of policies to promote the high-quality development of the tourism industry and ensure its steady and sustainable growth.”

Those remarks coincided with the 14th US-China Tourism Leadership Summit, held in Xi’an. Co-chaired by Brand USA and China’s Ministry of Culture & Tourism, the event “brought together government and travel industry leaders… to strengthen the tourism bridge between our two nations.” Weekly flights from China are forecast to “increase to 140 by the end of the year, compared to 65 in January 2024.”

A quick hop to Australia. At the 44th Australian Tourism Exchange, Phillipa Harrison, Managing Director of Tourism Australia, said: “We are confident this is the year we will return to those 2019 levels so we can stop referring to that benchmark and again focus on the sustainable growth of our industry”. She added: “(Even) China, which is an exceptionally large market for us, is sitting in the 70% mark now.”

And finally… an intriguing juxtaposition I referenced on the OAG Webinar: North East Asia - Growth & Recovery. Japan welcomed 11.6 million international visitors from January-April, while 3.9 million Japanese headed overseas. So, almost 3 times as many inbound visitors than outbound travellers. By contrast, South Korea welcomed 3.4 million inbound visitors versus 7.42 million Koreans heading overseas. So, more than twice the number of outbound travellers than inbound visitors.

Beyond the Circus: Cambodia’s Tourism Recovery

Phare, the Cambodian Circus, is based in Siem Reap and garners rapturous applause from visitors, but they have been in short supply since 2020. In response, Phare has hit the road, taking on one of the world's most critical live performance cities: New York.

So what happens next?

On The South East Asia Travel Show, Hannah chats with Craig Dodge, Phare’s Senior Director of Sales & Marketing, about the remarkable journey this creative social enterprise has taken - from low-fi beginnings in Battambang to the Big Apple.

Listen to ‘Running Away to the Circus, and Cambodia's Tourism Recovery, with Craig Dodge, Phare’, here:

Or search for The South East Asia Travel Show on any podcast platform

And, that’s a wrap for issue 142.

The Asia Travel Re:Set newsletter will return next Sunday.

Until then, find me at LinkedIn, The South East Asia Travel Show and High-Yield Tourism.

Happy travels,

Gary