Issue #139 - May Golden Week is the Hottest Tourism Topic in Asia Pacific!

China prepares for a "Super Golden Week."

Welcome to issue 139 of Asia Travel Re:Set.

Expectations are high across Asia Pacific as Chinese travellers prepare to take off for the upcoming Labour Day holiday.

Outbound bookings for the 5-day public holiday (1-5 May) are 13% below the 2019 level, Forward Keys noted this week. That is the aggregate figure. It will, of course, vary from destination to destination.

Expect some very big statistics to be reported for domestic travel - plus headlines about a recovery-confirming surge in outbound travel.

So, let’s preview preparations for the so-called “Super Golden Week”.

Thanks for checking-in.

- May Golden Week is the Hottest Tourism Topic in Asia Pacific!

China prepares for a “Super Golden Week”.

- The Return of Over-tourism, Chinese Tourists & Thailand’s Tourism Tax

April’s hottest tourism topics from Thailand, Singapore, Malaysia and China.

May Golden Week is the Hottest Tourism Topic in Asia Pacific!

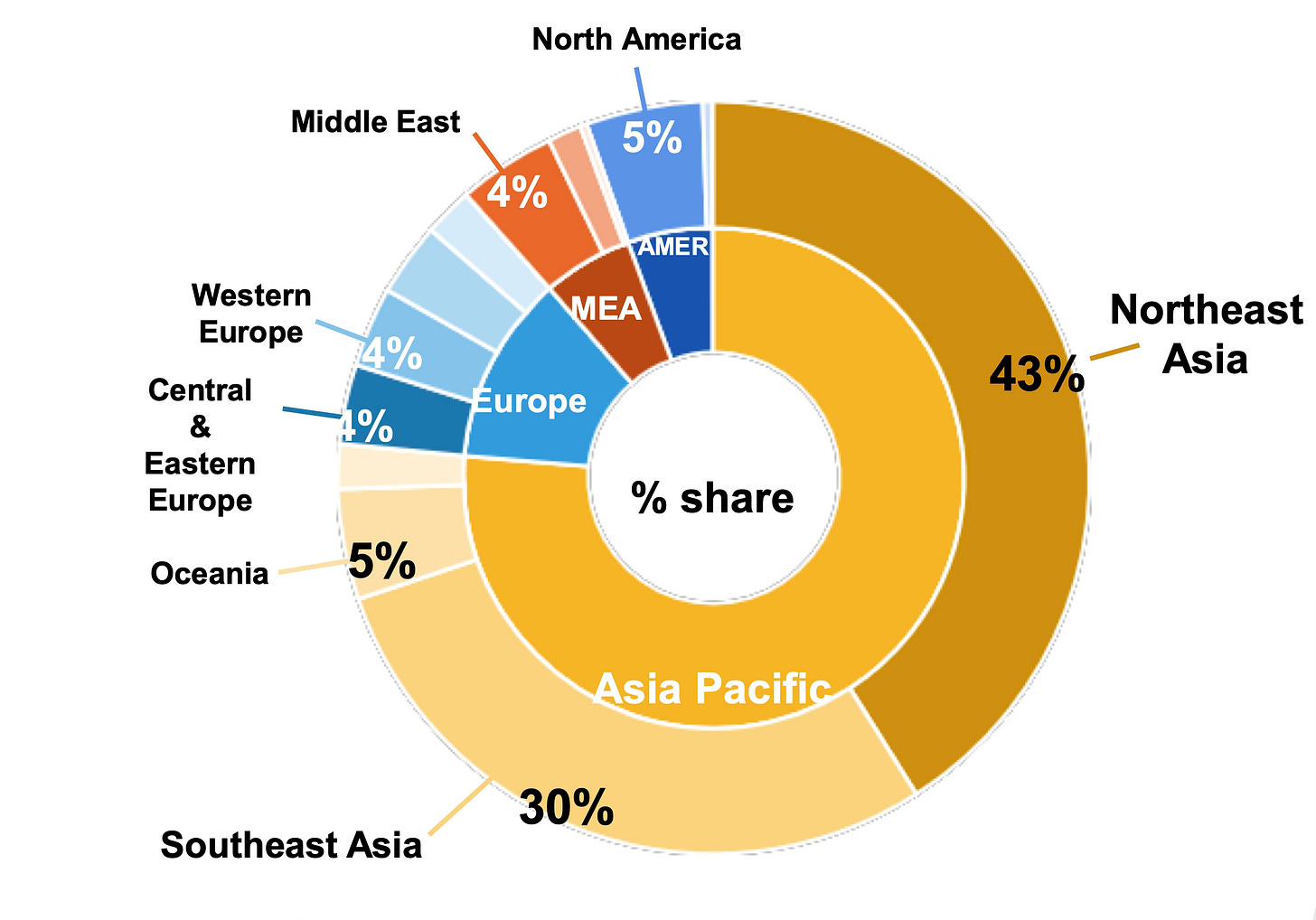

Source: Forward Keys

Let’s begin with a global overview of Chinese outbound tourism so far in 2024. The graph by Forward Keys breaks down Chinese travel bookings in Q1, with Asia Pacific accounting for 78%. As I said on The South East Asia Travel Show, the overall market distribution looks similar to 2019. That year, 8 destinations - Hong Kong, Macau, Japan, South Korea, Thailand, Malaysia, Singapore & Vietnam - greeted 71% of Chinese outbound travellers. We’re only one-third into 2024, so there may be a degree of evolution at the margins, but don’t bet your marketing budget on seismic change.

A always, front and centre for the May holiday will be Hong Kong. The Immigration Dept forecasts 5.9 million passengers (visitors and Hong Kongers) will pass through its air, sea and land control points. Some 86%, or 5.05 million, of the total will be cross-border travellers to/from/via mainland China. At least 800,000 mainland Chinese tourists are expected to visit Hong Kong during the holiday.

Macao is also gearing up for an influx, averaging around 130,000 visitors per day, but with less spending and casino gaming and lower hotel rates than for the Chinese New Year.

NB: As a quick reminder, there were 3.6 million outbound trips from China during the 8-day Chinese New Year holiday, 2.2 million of which were to Hong Kong and Macau.

Thailand has been busily promoting itself as a priority May destination in China and Japan. The two markets “will help a great deal to stimulate tourism expenditure,” says the Tourism Authority of Thailand. It is planning to receive “roughly 230,000 Chinese travellers during this period… with spending to reach THB9.1 billion.”

Amid the clamour to entice outbound Chinese tourists, it’s easy to overlook the phenomenal figures in domestic tourism. Take the city of Nanjing, the nation’s former capital, for instance. It attracted 65 million (yes, sixty-five!) visitors in Q1 2024, and is on track to smash the full-year 2023 total of 200 million. It will be a hot May holiday hangout.

Talking of which, here’s a quick recap of air passenger volumes to underline the vast difference between the domestic and international air markets in China. In Q1 2024, airlines carried 163.1 million passengers on domestic flights compared to 14.1 million on international routes (and 2.3 million on Hong Kong/Macau/Taiwan routes).

Hainan Island, which will be super-crowded next weekend, is taking steps to mitigate the departure chaos at the end of the CNY holiday. Limited flight slots saw prices skyrocket and homebound air and ferry tickets achieve gold dust status. The island’s 3 airports - Haikou Meilan, Sanya Phoenix and Qionghai Boao - have added “194 flights [resulting in] the addition of 32,965 seats” over the May holiday.

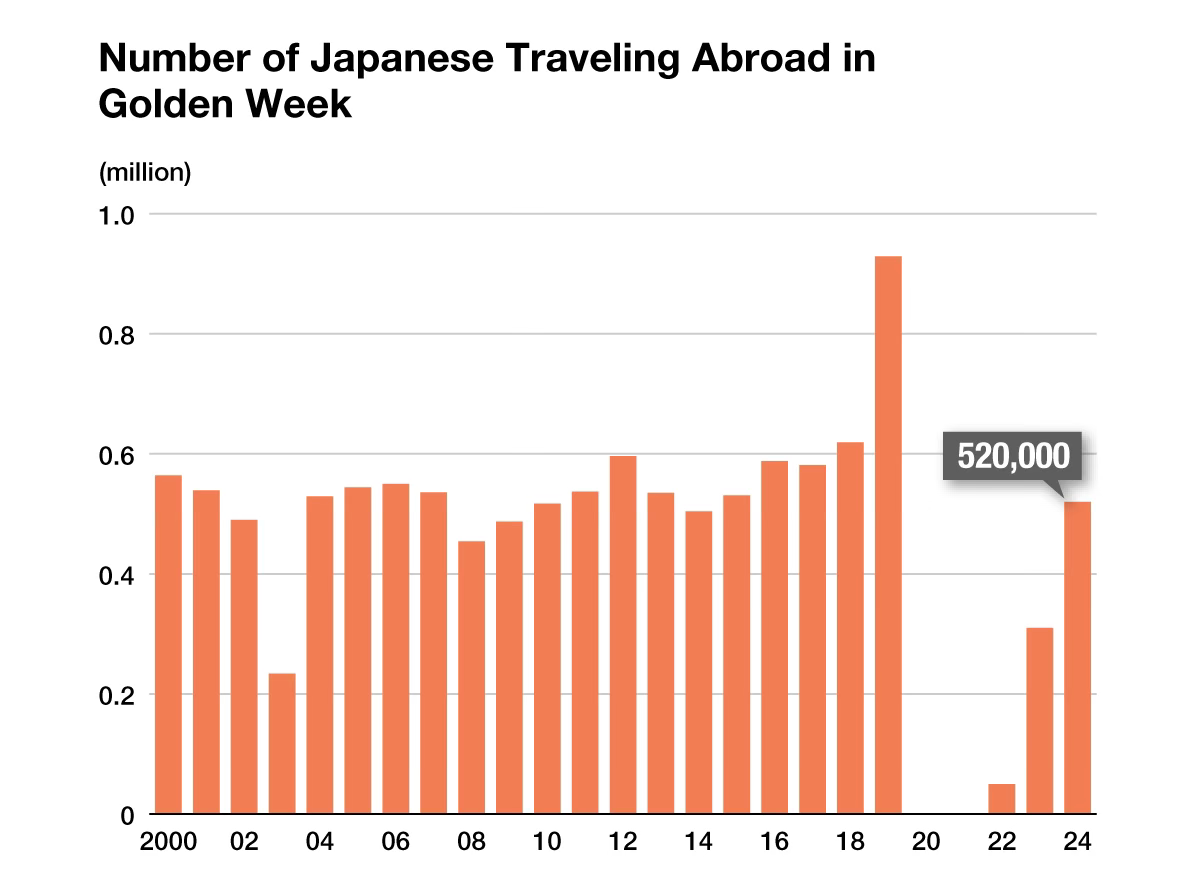

Source: Nippon.com

And finally… with all eyes on China, don’t overlook other North East Asian markets. Japan’s May Golden Week (29 April-5 May) will see an estimated 520,000 Japanese travel overseas. This would get close to the 2018 level. (2019 saw a fierce outbound surge as the May public holiday was extended for the first time). Even so, that figure is pretty vanilla compared to a forecast 22 million domestic Golden Week travellers.

The Return of Over-tourism, Chinese Tourists & Thailand’s Tourism Tax

What were April’s top 8 talking points? This week, we analyse an increase of Chinese arrivals across Asia Pacific, and preview the May Golden Week in South East Asia. We review travel volumes during Songkran, Eid/Lebaran and Khmer New Year, and discuss a Thai tourism leader’s call for a visitor tax to tackle over-tourism.

Plus, we delve into Singapore’s arrivals stats - which hit 95% of the pre-pandemic level in March thanks to a certain tortured pop poet.

Listen to ‘The Return of Over-tourism, Chinese Tourists & Thailand’s Tourism Tax: April 2024 in Review’, here:

Or search for The South East Asia Travel Show on any podcast platform

And, that’s a wrap for Issue 139.

The Asia Travel Re:Set newsletter will return next Sunday.

Until then, find me at LinkedIn and The South East Asia Travel Show

Happy travels,

Gary