Issue #111 - 5 Travel & Tourism Stories You May Have Missed This Week in Asia Pacific!

Future tourism planning in Maldives, a Big Bird in Bali and Hong Kong hits 10 million.

Welcome to issue 111 of Asia Travel Re:Set.

Anyone who has read the newsletter before will know I’m a travel stats junkie.

So, this week has been pure joy.

I spent much of it joining the Q1 earnings calls of Chinese OTAs, airlines and hotel groups as part of the research for Phocuswright’s forthcoming China Travel Market Report 2022-2026.

Three things emerge clearly:

Optimism is unabashed for China’s domestic travel sector in the 2nd half of 2023.

While international air capacity is returning and outbound demand is building, the supply side of China’s travel industry still faces major resource constraints.

Competition across the Chinese travel sector is intensifying, and everyone is keen to play down the prospects of a price war.

Meanwhile, May was a busy month for developments across the region.

So let’s follow that train of thought…

Thanks for checking-in.

- “IN THE NEWS”

- 5 Travel & Tourism Stories You May Have Missed This Week in Asia Pacific!

Future planning in Maldives, Bali’s Big Bird and Hong Kong hits 10 million.

- Top 10 Tourism Talking Points in South East Asia in May

Hannah Pearson and I discuss the most consequential developments in May.

“IN THE NEWS”

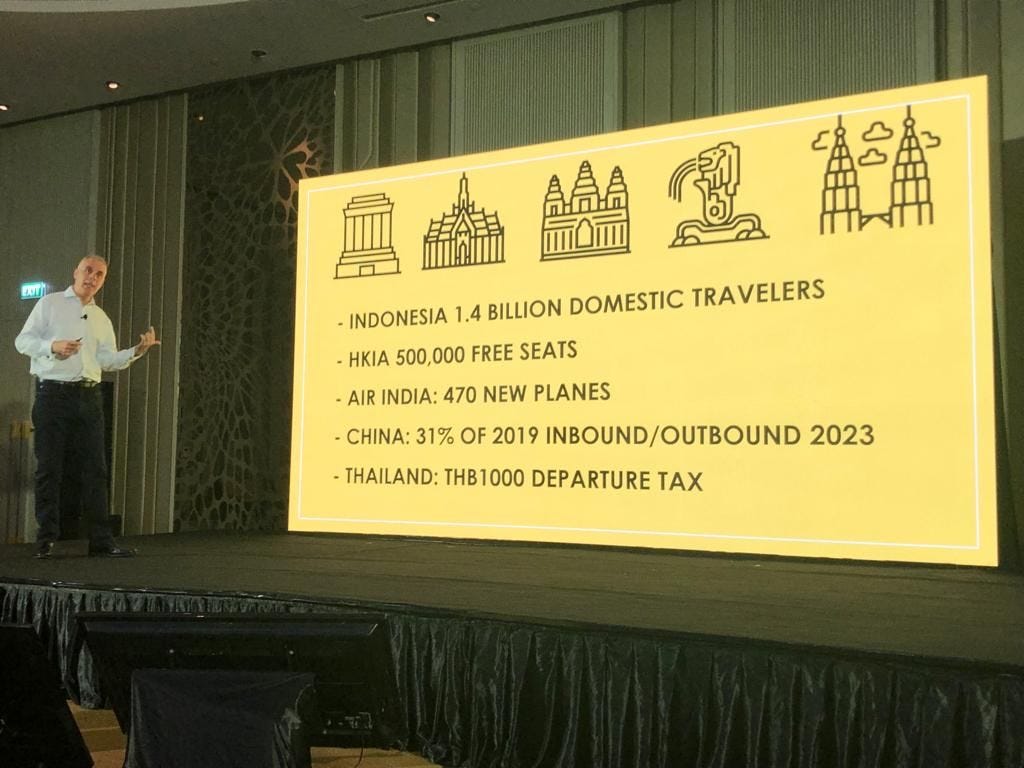

Yayoi Kusama's giant pumpkin. Crash Landing on You. China's City That Never Sleeps. Osaka 2025. Social Commerce. AR violinists atop Singapore's Victoria Theatre. Yozakura. What connects the dots? All are made-in-Asia concepts being used to engage consumers and stimulate tourism across the region. I included these in my keynote presentation at Worldline’s Rise Travel 2023 conference in Phuket.

“If there were to be another pandemic, would the travel industry be better prepared: Yes, No or Maybe?”' I enjoyed moderating this inter-continental panel - featuring Zaida Enver from South Africa, Cem Tintin from Turkey and Shukor Yusof from Malaysia - at this week's Halal in Travel Global Summit 2023 in Singapore.

5 Travel & Tourism Stories You May Have Missed This Week in Asia Pacific

1) Forward Planning in Maldives

“Tourism is key to Maldives’ economic prosperity, human wellbeing, and development success.”

After Maldives reopened for tourism on 15 July 2020, I was often asked by journalists “What can South East Asian nations learn from its success?” Three years later, a pertinent question is “What can Maldives learn from its success?”

Last week, Maldives published its 5th Tourism Master Plan (2023-2027). The 99-page document begins with an unavoidable truth. Tourism accounts for 43% of government revenues. Maldives aims to generate USD6 billion from tourism by 2027, up from USD3.5 billion in 2021. The Master Plan tackles 15 key areas of future development with a similar forthrightness.

Unlike most national tourism plans, it doesn’t just ride the obvious Government-Destination PR branding tramlines. It creditably dives into complex issues, like community development, climate impact, fair trade, energy security, cybercrime, food waste and capacity building infrastructure cost-benefit analysis.

Well worth a read, Click HERE.

2) AirAsia Lands in Fuzhou

“We hope this cooperation can build an air bridge between Fuzhou and Southeast Asia.”

Last week, AirAsia signed a “cooperation framework” with the Chinese city of Fuzhou. The goal, said Karen Chan, COO, is to enable “travellers in Fuzhou to connect to hub airports in Malaysia, Indonesia, Thailand and the Philippines.”

Located in Fujian province, north of Xiamen and south of Wenzhou, Fuzhou resides close to, but outside of, the Guangdong-Hong Kong-Macau Greater Bay Area (GBA) - a vast development zone incorporating 11 cities in southern China. This suggests foreign LCCs might not be permitted to set up bases in the GBA.

AirAsia entered China in 2005, and has developed a strong route network. Less successful was an attempt in 2017 to create China’s first foreign joint venture LCC, based in Zhengzhou. The carrier says it currently operates 205 weekly services with mainland China, or 63% of pre-Covid capacity. It intends to reach 100% by July.

3) Hong Kong Hits 10 Million

“We are concerned about the pace of air capacity restoration.”

Most Asian destinations would be happy hitting 10 million visitors at this time of year (Thailand certainly is). In the first 5 months of 2023, Hong Kong averaged more than 2 million monthly visitors. In the same 2018 period (a reliable base year, given the impact in 2019 of the long-running protests), monthly arrivals averaged 5.17 million.

As reported in Issue 110, traffic at Hong Kong International Airport is rebuilding. The Hong Kong Tourism Board, though, is concerned that airlift remains sub-par, especially from Mainland China, reports South China Morning Post. On that note, I refer you back to point 2. of today’s intro.

Intriguingly (and discussed on this week’s The South East Asia Travel Show), high-speed rail arrivals from the mainland are increasing. Is this offsetting a slow air supply recovery, OR is it a consequential driver? A clearer picture should emerge in the second half of 2023.

4) H World Steps Up Lower-tier Cities Expansion

“We will continue implementing our lower-tier cities penetration strategy.”

Hotel supply growth in China is expected to scale up over the next 12-24 months as the domestic recovery gains pace. A key focus will be the lower-tier cities - usually defined as tier-3 and below, which are home to two-thirds of China’s urban population.

Speaking on this week’s Q1 Earnings Call, He Jihong, CFO of multi-brand Chinese hotel group H World, said lower-tier cities “offer plenty of growth opportunities, especially considering the rising spending power supported by high economic resilience.” Formerly known as Huazhu, H World is a partner of Accor in China.

At the end of March 2023, H World operated 8,464 hotels, 39% of which were in lower-tier cities. Some 56% of the group’s pipeline of 2,304 hotels is in lower-tier cities.

5) Big Bird in Bali

“The first-ever scheduled A380 service to Indonesia.”

Remember the forecast demise of the double-decker Airbus A380 during the dark days of Covid-19? On Thursday, Emirates brought the first commercial service of the world’s largest passenger plane to Bali. The service offers 58 Business class and 557 Economy Class seats.

Greeting the inaugural flight was a clutch of officials and VIPs, including Wayan Koster, the Governor of Bali and proponent of schemes such as a Tourism Quota to restrict the volume of “foreign tourist arrivals” and, according to the Bali Sun, a new decree banning all “mountain tourism” in Bali.

Top 10 Tourism Talking Points in South East Asia in May

Was May 2023 the most consequential month so far for the travel recovery in Asia Pacific? Possibly. It kicked off with China's highly anticipated Golden Week, which delivered 274 million domestic trips and 3.2 million outbound trips. 6 of the Top 10 Golden Week destinations were in South East Asia, according to Mafengwo.

On The South East Asia Travel Show's monthly round-up, we discuss the Golden Week among a list of 10 key talking points from across South East Asia and beyond. We journey from Augmented Reality Experiences and Record Airline Profits to the post-election outlook for "Cannabis Tourism" in Thailand. Plus, which Malaysian city has a proposed harbour-front development touted as "The New Milan"?

Listen to The Top 10 Travel & Tourism Talking Points in South East Asia in May, here:

🎧 Website 🎧 Spotify 🎧 Apple Podcasts

Or search for The South East Asia Travel Show on any podcast platform

And, that’s a wrap for Issue 111.

The Asia Travel Re:Set newsletter will return on 18 June.

Until then, find me on LinkedIn and at The South East Asia Travel Show - where this week we’ll be discussing Chinese travel payments with Alipay.

Happy travels,

Gary