Asia Travel Re:Set #31 - The Pandemic 12 Months On: 10 Shared Learnings for Travel & Tourism

"Shape-shifting travel industry change isn't coming. It's arrived and checked-in."

Hello. Welcome to Asia Travel Re:Set…

One year ago this week.

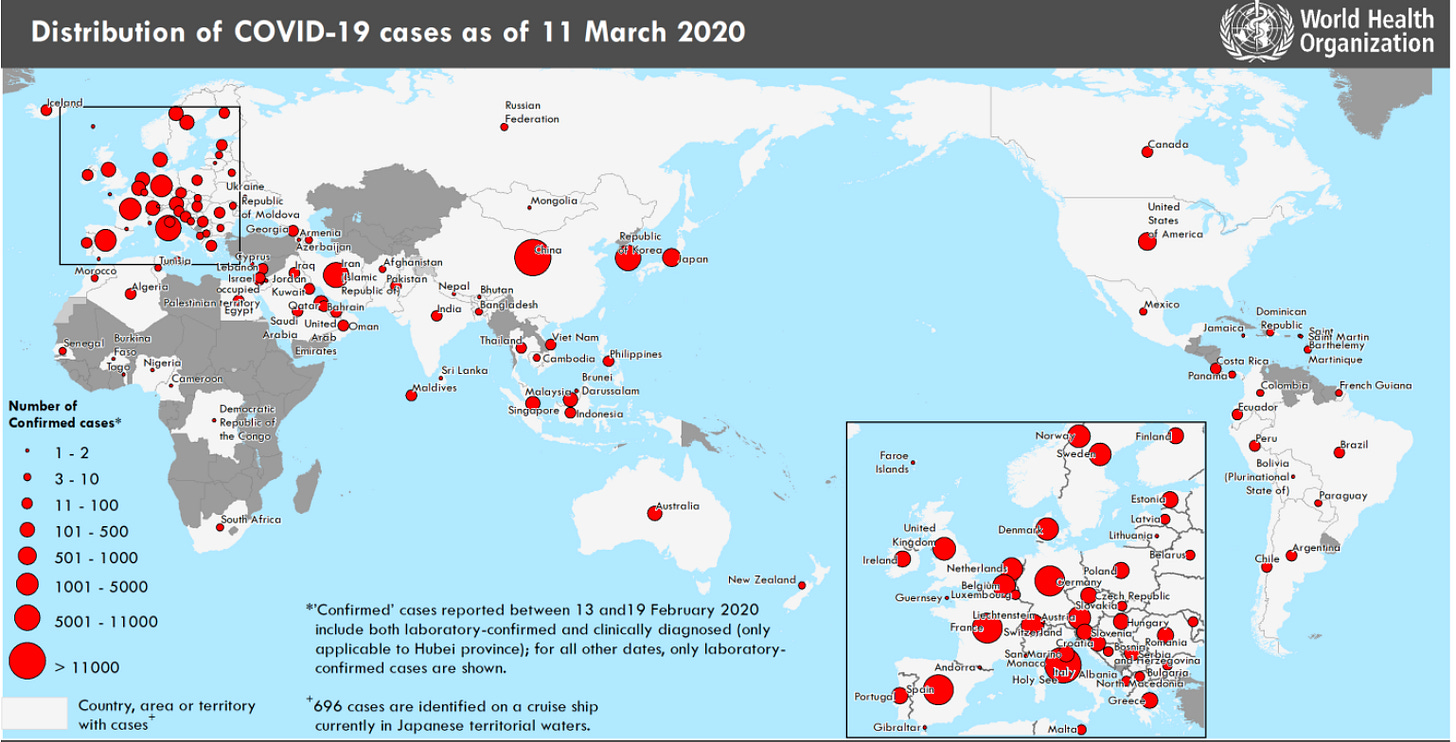

On 11 March 2020, this happened:

“The WHO has been assessing this outbreak around the clock and we are deeply concerned both by the alarming levels of spread and severity, and by the alarming levels of inaction. We have therefore made the assessment that COVID-19 can be characterised as a pandemic.”

A single phrase stood out then, and stands out now: “the alarming levels of inaction.”

Just a few days before the WHO announcement, something else intriguing occurred.

On 5 March, the World Tourism Network (WTN) rose from the ashes of the postponed ITB Berlin show. But would it be just another travel body in a cluttered space?

Evidently not. This one has real grit, fresh ideas and international buy-in.

This week, the WTN hosted two global webinars to mark its first anniversary. Entitled “One Year Rebuilding Travel,” they presented practical concepts by diverse destinations, from South Africa to Serbia, Malaysia to Jordan and Australia to Hawaii.

Some 40,000 travel industry representatives tuned in across the globe.

I’ve attended and spoken at countless tourism events over the past year, but this one felt different for 3 reasons.

Firstly, there is a palpable sense of optimism that the pandemic tide is starting to turn, and that the lights may soon be switched back on.

Secondly, zero bluff and bluster. Each speaker pragmatically confronted the myriad challenges that the travel industry knows it must face and overcome.

Thirdly, attention was given to rethinking, relearning and realigning travel for a world that is, unquestionably, changed forever.

New Indonesian Tourism Minister, Sandiaga Uno, even took questions live from the back of his car and made a video ‘wefie’ with hotel staff upon arriving in Likupang - one of Indonesia’s ‘5 Super Priority Destinations’ of the future.

It was stirring stuff - especially the universal recognition that shape-shifting travel industry change isn't on the horizon. It has already arrived and checked-in.

So, in the spirit of looking back and pressing ahead, I’ve analysed 10 Shared Learnings for Travel & Tourism from the dark 12 months that we have just experienced.

Thanks for being on board,

Gary

Each Sunday, Gary Bowerman charts the week’s key talking points for visitor economies across Asia Pacific.

The Sunday Itinerary

- DashBoard

From 118,000 down to 81 on 11 March 2020 - the day the pandemic was declared.

- QuoteBoard

Vaccine tourism in Maldives, Tourism reopening in Seychelles, Olympics in Tokyo.

- The Pandemic 12 Months On: 10 Shared Learnings for Travel & Tourism

From vaccines to islands, domestic travel to comeback markets and ancillary fees to plastic trash.

DashBoard

From 118,000 down to 81 on 11 March 2020 - the day the pandemic was declared.

118,319: Total number of COVID-19 case infections recorded worldwide.

4,292: Number of people who had lost their lives to COVID-19.

68%: Of total cases (80,955) were recorded in China.

114: Total countries with recorded COVID-19 cases.

81: Number of countries registering zero COVID19 cases.

Source: WHO

QuoteBoard

You heard it here…

"Some countries are calling this Vaccine Tourism. When a vaccine dose is completed and the waiting period, if there is any, is completed, a vaccine card is given. When that card is received, travelling has been allowed without any more tests. This is the best time for the Maldives to do this and benefit.”

Dr. Abdulla Mausoom, Tourism Minister of the Maldives, announces PCR test-free access for vaccinated visitors. [One Maldives]

"We will be able to reach our target [to vaccinate 70,000 residents] for adequate immunity in the community to break the chain of transmission. This will allow us to open safely to our tourism industry with minimal disruptions to our normal lives.”

Jude Gedeon, Public Health Commissioner of Seychelles, updates the media on the nation’s vaccination programme ahead of the tourism reopening on 25 March. [Seychelles News Agency]

“The current situation is to not allow entry to even a single tourist as a way of dealing with the pandemic. From a realistic standpoint, it would be difficult to allow in foreign spectators for the Olympics.”

Spokesperson for Yoshihide Suga, Prime Minister of Japan, updates the media on the latest Tokyo 2021 Olympics situation. [The Asahi Shimbun]

The Pandemic 12 Months On: 10 Shared Learnings for Travel & Tourism

No-one was Prepared. “Pandemic” is a scary word, made more sinister by the fact that we only previously encountered its impacts by watching disaster movies. Governments and corporates that read the pre-COVID-19 real-life risk reports placed them back in a drawer. The travel sector paid no attention to the potential destruction that a pandemic would inflict. It’s easy to say this now, but it was also easy to assume that a pandemic would not occur “in our lifetime.” There will be no excuse in future. The likelihood of a future pandemic is scarily real. The world must build this into all economic, social and healthcare framework planning.

Vaccines ARE/AREN’T the Only Tool in the Box. The travel industry - aware that vaccine rollouts in many countries will take most of 2021 (although in smaller nations it will be faster) - wants unified international collaboration on pre-/post-flight testing to open up the skies. Governments, which for the last year kept borders closed on the premise that it is unsafe to unlock them until vaccines are administered, find it difficult to shift their overall stance on testing. It was far easier to lock down nations than it is proving to reopen them. This is a tough circle to square. A universal - or at least, in phase 1, a regional - vaccine passport (or Digital Health Pass) is vital, though. Can the EU and/or ASEAN take a lead?

“Governments, which for the last year kept borders closed on the premise that it is unsafe to unlock them until vaccines are administered, find it difficult to shift their overall stance on testing.”

Islands are in the House Seat. Island locations are likely to dominate the early-phase reopening roster in Asia Pacific. Free of border constraints, isolated from land-locked populations and with their own infrastructures and (fragile) ecosystems, islands are desirable and manageable destinations in the current era. Maldives reopened successfully in July, and is preparing to greet vaccinated visitors. Sri Lanka is open, Seychelles will open on 25 March. Indonesia’s Bali and Bintan may not be too far behind. Thailand’s economic strife means it has little option but to plan for reopening its islands. Malaysia may follow with Langkawi. The Philippines has a panoply of choices.

Land borders present bigger problems for governments. Controlling restricted people flows will be particularly tricky in South East Asia, where some borders are notoriously porous. Over recent months, COVID-19 outbreaks in countries like Thailand, Malaysia and Vietnam were blamed on illegal border crossings. Conversely, both Malaysia and Singapore would enjoy an economic uplift from restoring their causeway crossing. Border management will present perhaps the toughest challenge for policymakers over the next 6-12 months.

“Border management will present perhaps the toughest challenge for policymakers over the next 6-12 months.”

The Quest for ‘Comeback Markets’. Two recent case studies highlight the importance of securing connectivity with comeback markets. Bali attempted to reopen last September but was stymied by Indonesia’s COVID-19 infection rate and widespread outbound travel bans in its key source markets. Reopening is one thing. Ensuring people are able to visit is another. Maldives opened successfully last July, and has attracted travellers from European and Middle Eastern markets, India and Russia - but not yet, of course, China. Over the past 7 months, Maldives benefited significantly from competitor destinations being closed. That will change over the coming months - and competition will intensify to attract travellers from major outbound markets - and yes, China, is the most coveted.

In South East Asia, outbound and inbound travel are mostly prohibited right now, but that will change. Once one nation makes a reopening play, a ‘rolling stone’ knock-on effect will ripple through the region. The 10 countries of ASEAN will battle intently to entice tourists from each other - as well as China, India, Japan, South Korea, Middle East, Russia, Europe, US et al. Governments have tracked each other’s inactivity on border reopening over the past year, and they do not want to be left behind once the travel action begins to reactivate.

“In a new world of hyper-experiential travel expectations, travellers will want to be indulged and pampered, not categorised and counted.”

Within the context of rebuilding comeback travel, annual volume setting is a mindset that must change. Arbitrary arrivals targets will add counter-productive pressures on travel firms that are slowly reforming and rebuilding. Moreover, travel consumers are ever-more unlikely to accept being branded in statistical terms. In a new world of hyper-experiential travel expectations, travellers will want to be indulged and pampered, not categorised and counted.

DON’T Ditch Domestic. The enforced pandemic-era shifting of the inbound-outbound-domestic travel equation is up for revision. Governments and tourism boards have implored citizens to travel and spend at home almost as part of a national duty to support toiling economies. And while domestic destinations and in-situ businesses have responded with creative promotions and tailored offerings, the tour operator and travel agency sectors have struggled. Domestic trip choices and spending priorities differ to inbound visitors. They just do.

Home-grown travel has gained a broader platform, and this should be nurtured and developed. This week, Tourism Australia revamped its Holiday Here This Year domestic travel campaign, and a new survey in Vietnam emphasised that ‘Safe & Nearby’ (and Short-Stay) may remain a guiding travel mantra in 2021.

“We are calling on Australians to help support their fellow Australians by booking a city escape, which in turn will help to support the thousands of city-based hotels, restaurants, bars, cultural attractions and experiences that rely on tourism for their livelihoods.”

Phillipa Harrison, Managing Director, Tourism Australia

Everyone is Rethinking the ‘Meaning of Travel’. The travel sector often focuses on supply and demand, travel providers and travellers - them and us. Even in the pre-COVID era of putative “personalisation,” this endured. Too much loose talk was committed to “owning the customer”. No more. Travellers will dictate terms. COVID-19 has united everyone who travels or is involved with the business of travel to take stock of our human vulnerability, personal wellbeing and our taken-for-granted mobility. Consumers understand the post-pandemic sacrifices they may need to make, and expect travel providers to do likewise. Adapting to this capricious quest for meaning will define the travel industry’s immediate future.

Following from the point above, this is very good: The Meaning of Travel by Emily Thomas

And this is a highly readable review of the book by Stuart McDonald of Travelfish

Economic Realism WILL Apply. Across Asia Pacific, the pandemic dislocated economic systems. Travel and tourism infrastructures have also been damaged. Airplanes remain parked, pilots and crew furloughed, hotels, restaurants and stores closed, travel firms shuttered. Consumers are also confronting their own financial difficulties, and their ability to commit discretionary income to travel.

Despite continuing to grow overall, China’s economy shifted structurally over the past year. Small businesses are suffering and jobs are being shed. The economies of India and Japan shrunk notably last year, while South Korea faces its highest unemployment rate since 1997. These are vital travel markets for the region.

In ASEAN, intra-regional travel was flourishing pre-pandemic, but Indonesia, Thailand and Malaysia - three dynamic sources of travellers across South East Asia - are facing constrained economic times. An initial travel rebound later this year is likely across parts of the region, but it won’t mask the deeper structural issues that travel economies must confront.

“An initial travel rebound is likely later this year, but this won’t mask the deeper structural issues that travel economies must confront.”

Ancillary. Ancillary. Ancillary. Low-cost carriers made travellers more comfortable with additional costs. Fact. The scale and scope of add-on fees will become more apparent when travel restarts. Cambodia surprised everyone last year with a USD3,000 deposit-on-arrival requirement to cover potential medical bills (and funeral costs!), and Thailand won’t be the only nation proposing a new tourism tax. The on-hold Hong Kong-Singapore Air Travel Bubble was predicated on self-paid COVID-19 tests, and buy-now-pay later deals are notable for what they don’t, rather than do, include. People may even request extra costs related to their own safety and comfort. This week, Emirates began selling spare seats and entire rows at discounted rates in response to passenger feedback.

Journeys in a Contact-Free World. ‘High Touch, Low Touch, No Touch’ was a prominent hotel industry hashtag when China reopened domestic travel last year. It enabled hotels and guests to grade which public areas could be rendered contactless, which ones could rely on minimal human touch, and areas - such as restaurants, gyms and spas - where a high-degree of hand contact is the norm.

China is one of the world’s most frictionless economies. Cash and credit cards have been largely replaced by QR codes, and most consumer interactions are either screen-based or touch-free. Chinese travellers are accustomed to using their smartphones to board a flight, take a high-speed train or check-in to a hotel. During the pandemic, destination and travel marketers engaged grounded Chinese travellers with tech-heavy virtual tours and live-streamed experiences.

Consumer trends from China filter seamlessly into South East Asian markets, albeit with a (shortening) time lag. Having spent 12 months social distancing, scanning health-check QR codes and spending via cashless wallets, contact-free travel will be expected rather than hoped-for.

The Environmental Crisis is Next. A cursory glance at consumer purchasing trends in Asian online markets shows that up-cycled and plastic-free packaging and biodegradable items are gaining popularity. People have had a year to consider the perilous state in which the planet finds itself. They are unimpressed. Sustainable, responsible and regenerative travel are terms that need reworking, because the tourism sector will be in the eco-cross hairs. And not just because of plastic trash. Waste management, air pollution, land degradation from over-development and the poisoning of marine life will all gain closer scrutiny.

Travel needs to be proactive. Gone are the days of green-washed branding and questionable carbon neutrality. Travellers will not accept excuses, and they have a better handle on the key issues - especially the climate crisis.

And, that’s a wrap for Issue 31.

Until next week, I will be on Twitter, LinkedIn and the Asia Travel Re:Set website.

And feel free to send over comments and feedback to gary@check-in.asia

Have a great week,

Gary